A scaled order is an algorithmic order type that executes big orders without instigating violent market volatility or impacting market participants’ behavior. A scaled order splits a large order into several sub-orders within a specific price range and places them as separate limit orders at incrementally increasing or decreasing prices.

In a scaled buy, orders at lower prices are triggered in sequence as the market price falls. A scaled sell does the opposite, filling orders at higher limits as the market price increases. Scaled orders are useful when opening or closing a position to achieve a better average price, or to provide control over order distribution and diversity within the price range.

Here are some key advantages of Scaled Order:

- Less Slippage: Scaled orders divide large orders into smaller sub-orders, curbing sudden price movements and slippage caused by heightened volatility.

- Enhanced Execution Control: Scaled orders allow you to adjust order size and timing according to market conditions to capitalize on short-term fluctuations while maintaining steady control.

- Diversified Entry Points: Scaled orders enable entries at various price levels, covering a range of prices for improved trade outcomes and trend identification.

How Does Scaled Order Work

Bybit offers four (4) types of Order Quantity and Price Distribution for the Scaled Order function: Flat, Increasing, Decreasing, and Custom.

|

Distribution | |

|

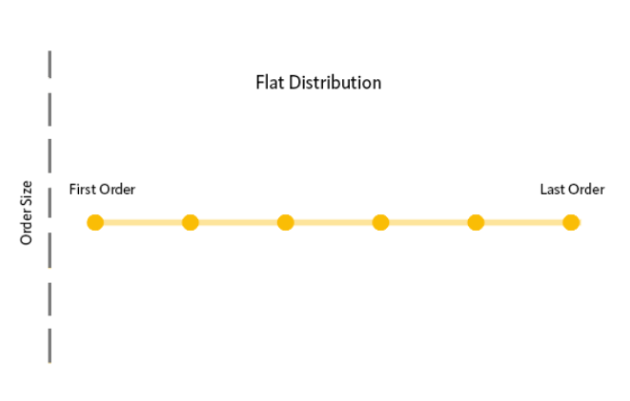

1. Flat/Evenly Split

|

|

|

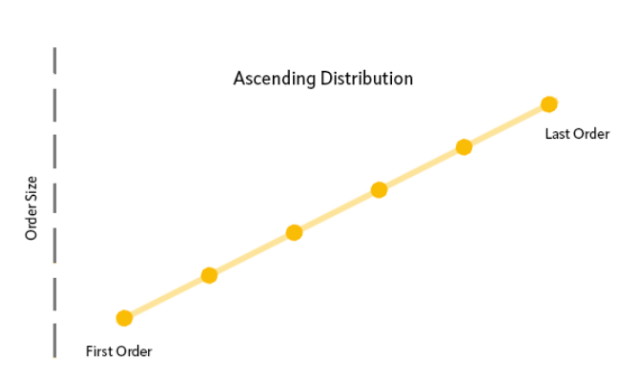

2. Increasing

|

|

|

3. Decreasing

|

|

|

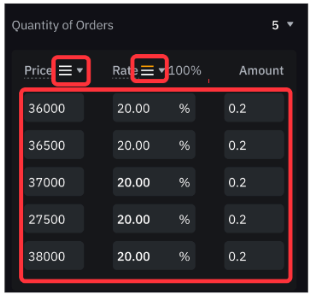

4. Custom You can set the distribution uniquely based on your own investment strategies. However, there are several things to take note of. |

Note:

|

Example

Take ETHUSDT Contract as an example. Assuming the current market price is 1,550 USDT, Alison wants to enter a short position with a quantity of 1,000 ETH. Instead of a single order, Alison placed a Scaled Order based on the following parameters:

Total Order Size: 1,000 ETH

Order Count: 10

Order Size Distribution: Flat

Each Sub Order Size: 100 ETH

Price Range: 1,600 – 1,780 USDT

Price Increment: 20 USDT

Average Sell Price: (1,600+1,620+...1,780)/10 = 1,690 USDT

Once the order is submitted, 10 limit orders will be placed into the order book. The first sub-order of 100 ETH will be placed at 1,600 USDT, and subsequent sell orders will be placed at 1,620 USDT, 1,640 USDT, 1,660 USDT, and so on, until the entire order is filled by the time the price moves above 1,780 USDT, with an average filled price of 1,690 USDT.

Please note that when the current market price is better than the sub-order price, the order will be filled immediately at the best available market price. To understand more about how limit order works, please visit here.

How to Submit a Scaled Order

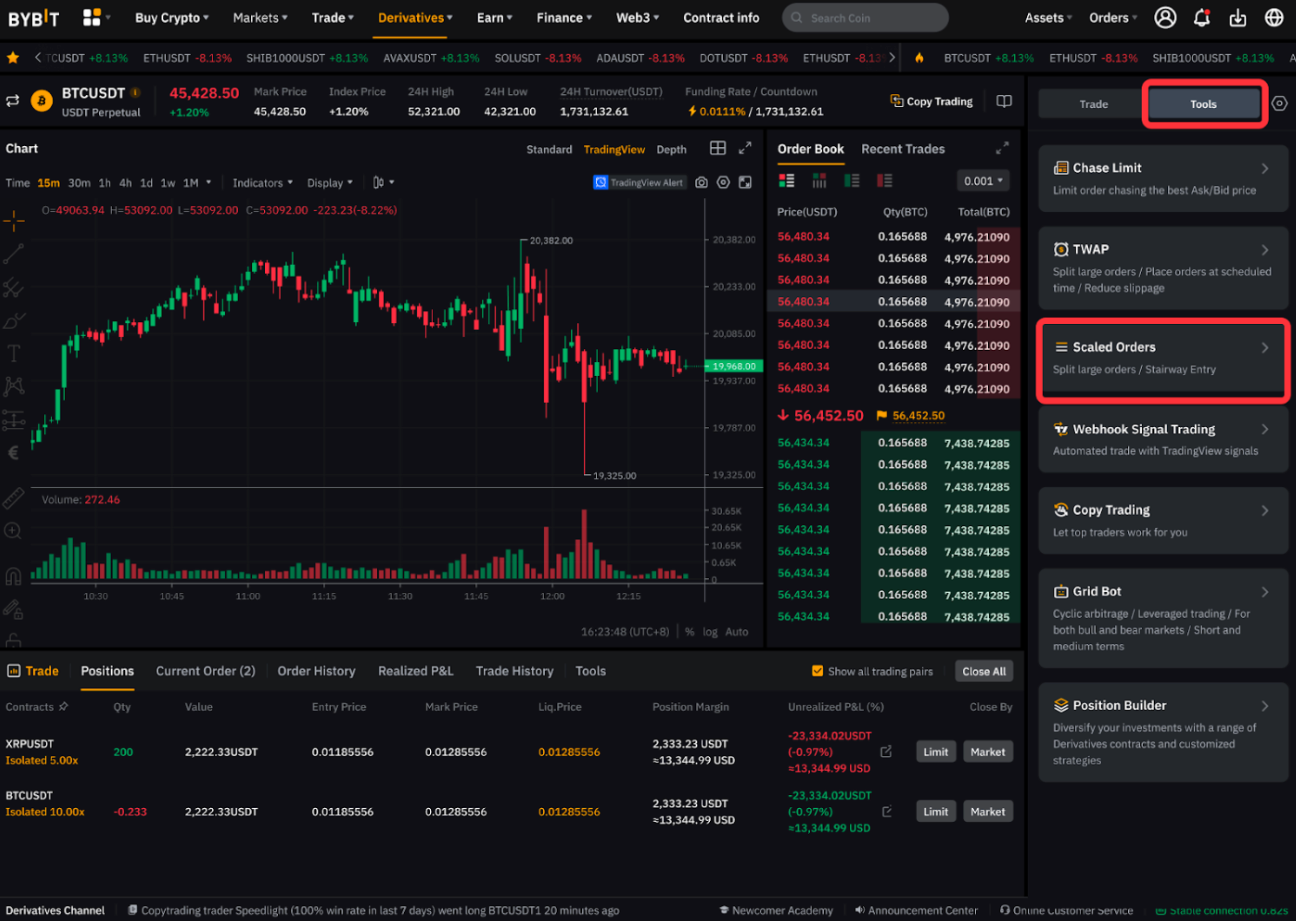

Step 1: Log in to your Bybit account and visit the Derivatives trading page.

Step 2: Select the contract you wish to trade.

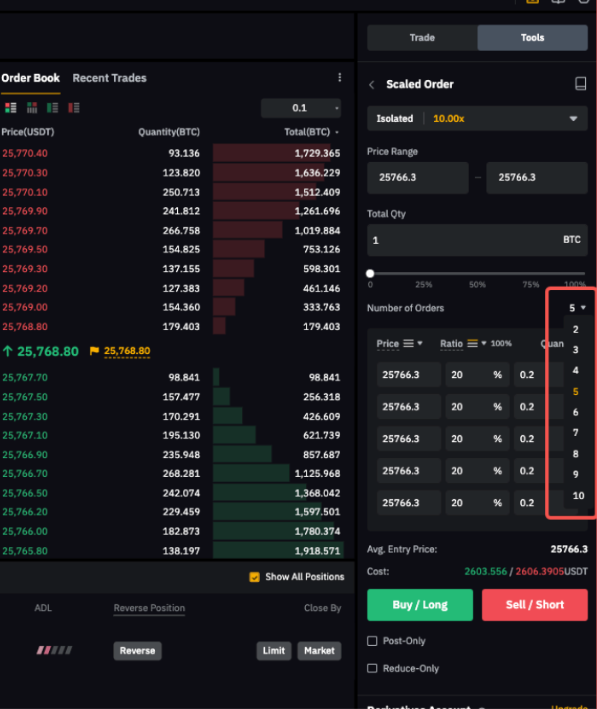

Step 3: On PC, click on the Tools tab and select Scaled Order. Input your preferred Price Range (the upper and lower bound of your scaled order) and Total Qty for your scaled order.

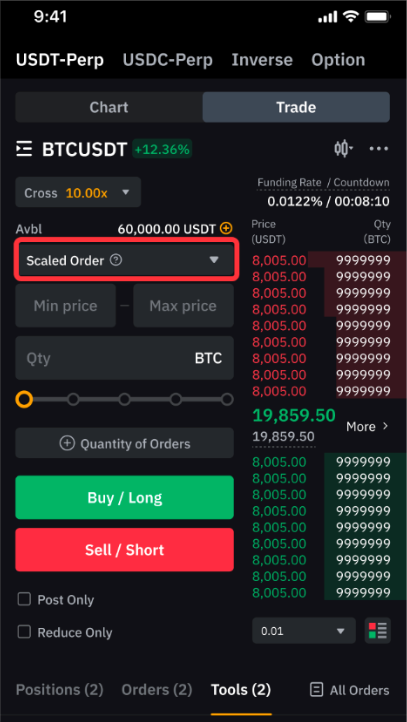

On the App, go to the Trade tab. Tap on the order type dropdown menu, select Scaled Orders, and input your preferred Price Range (the upper and lower bound of your scaled order) and Quantity for your scaled order.

Please note that the minimum and maximum total quantity for a Scaled Order is 10 times the minimum and maximum order size. For example, the minimum and maximum order size for BTCUSDT is 0.001 BTC and 100 BTC. The minimum and maximum total order quantity for the Scaled Order will be 0.01 BTC and 1000 BTC respectively.

Step 4: Click on Number of Orders, and select your preferred Order Count from the dropdown menu.

Step 5: Choose your Price or Order Size Distribution.

- You may choose to distribute your order evenly (Evenly Split), or with geometric increments in either direction (Increasing or Decreasing).

- You may also set the distribution to your liking (Flat, Increasing or Decreasing) by keying in the price and variance percentage manually.

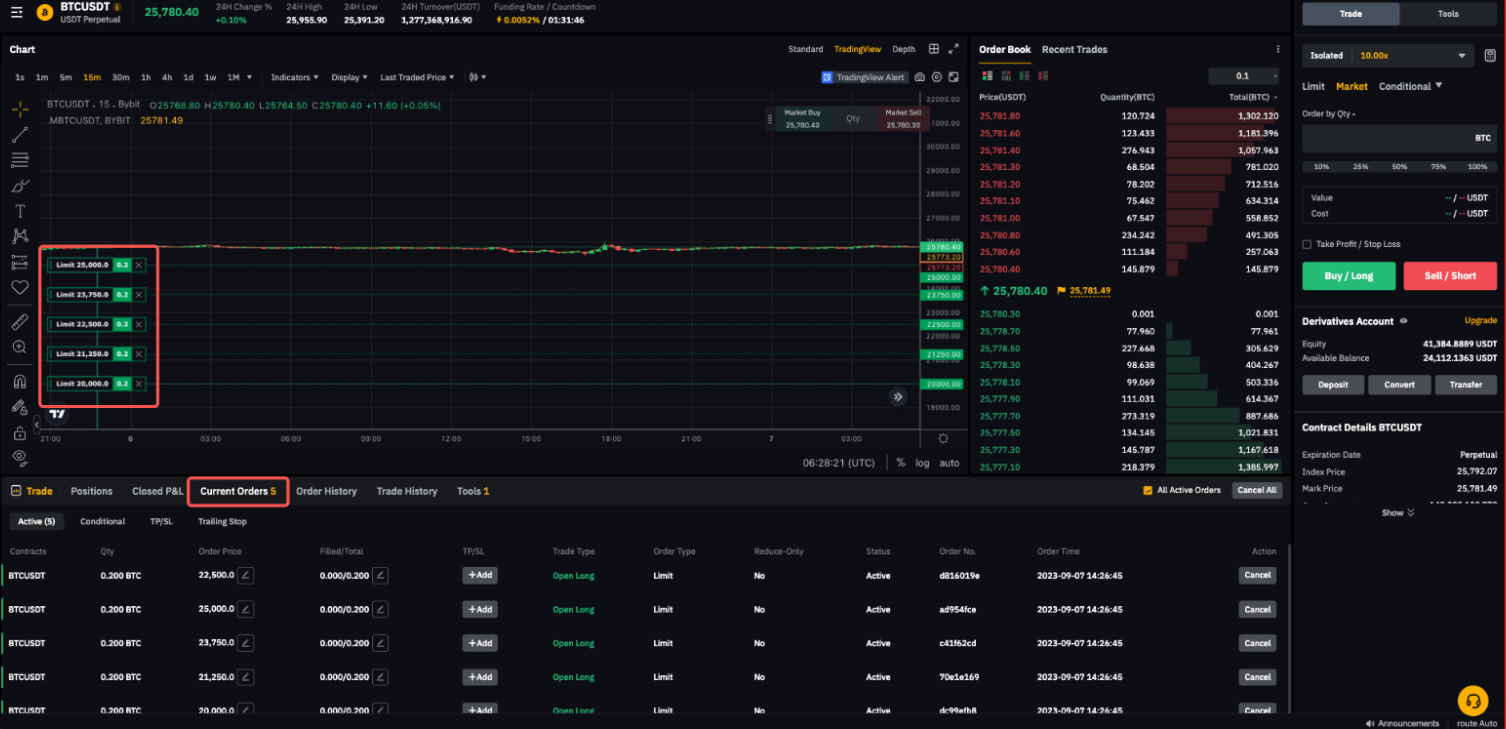

Step 6: Review, confirm, and submit your order. Depending on your preset price variance, some of your limit Scaled Orders may be filled immediately. In such cases, a window will pop up to inform you of the possibility of filling a limit order immediately and ask for your confirmation.

After submitting a scaled order successfully, your chart will be updated to reflect your scale order at different price variances accordingly. You can check your placed limit order from the Current Orders tab.