The safety of our users’ assets is always our top priority. However, the methods of fraud are constantly evolving today. P2P traders themselves serve as the first line of defense against scams and fraud. When engaging in P2P transactions, it is crucial to be aware of the most common scam tactics in order to protect yourself from falling victim to fraudulent schemes.

Here are some common types of P2P Crypto Scams to be aware of:

1. Fake Receipt Scams / ESCROW Transaction Scams

This type of scam happens when scammers send you fake receipt(s) — e.g., forged receipts or screenshots — as proof of their payment, or a phony counterparty insists on an ESCROW transaction, promising that the payment will only be reflected in your wallet after you release your crypto holdings.

How to Prevent Fake Receipt / ESCROW Transaction Scams:

-

Always double-check your wallet/bank account to confirm that you’ve received the agreed-upon amount before transferring any crypto assets.

-

Don't succumb to intimidation tactics employed by scammers, including aggressive language and attempts to push you to release your crypto holdings.

-

Don’t be afraid to walk away from the transaction if things start to become suspicious. If you are unable to reach a mutual agreement, please immediately contact our Customer Support team for assistance.

2. How to Avoid Mutual Agreement Scams

Scammers may attempt to trick users into clicking Mutual Agreement during an appeal. Please be cautious, as clicking this option means you are canceling the order and the Seller’s crypto will be released. This action is final and cannot be reversed.

How to Prevent Mutual Agreement Scams

-

Avoid clicking “Mutual Agreement” under pressure from the counterparty. Only select "Mutual Agreement" if you are certain you have not made any payment or you have already received a verified refund.

-

Do not rely solely on the counterparty’s claims or screenshots. Always check your own payment account before confirming.

-

If the counterparty pressures you, or you believe the appeal was submitted maliciously, choose Negotiation Failed and provide your evidence.

-

If no action is taken before the countdown ends, Bybit will intervene. However, the outcome may not be in your favor without valid proof.

Reminder: Bybit does not hold or escrow any fiat or cryptocurrency on behalf of users.

3. Bybit Impersonators

Beware of scammers who contact you via private message or email, posing as Bybit representatives. They may instruct you to immediately release your crypto holdings to prevent them from being frozen. These impersonators obtain your contact details from the information you’ve provided in your ads/P2P order chat. They could ask you to share your email address in the P2P chat window, claiming that it’s necessary for Bybit’s P2P Escrow service to confirm payment. They would then send you a phishing email similar to official Bybit communications, and trick you into releasing your crypto first to receive payment.

How to Prevent Impersonator Scams:

-

Do not accept third-party payments. Always verify the payer/payee’s name and ensure it matches the counterparty's verified name on Bybit.

-

Bybit will never send emails asking you to complete a P2P transaction. Always release funds after receiving the payment.

-

Pay attention to the username, email address, or phone number of the person contacting you. Always verify the authenticity of email addresses, telephone numbers, and URLs using the Bybit Authenticity Check.

-

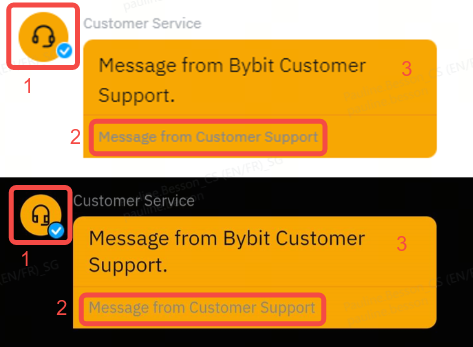

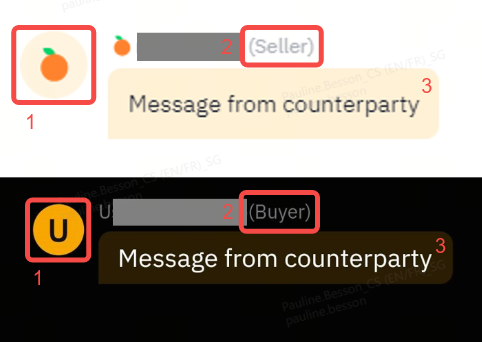

Always check the profile avatar and the style of the messaging bubble in the P2P Order Chat Box to ensure you are chatting with the real P2P user. A useful tip for you here:

|

From Bybit Customer Support |

From your counterparty | |

|

On the Website

On the App |

|

|

|

1 Profile Avatar |

The profile picture of all Bybit Customer Support’s messages will be the headphone icon and the official blue tick will appear at the bottom right side. |

The profile picture of your counterparty will be the first character of their nickname. |

|

2 System Tag |

“Message from Customer Support” will be shown below the message sent from our Support team. |

The mentions “Buyer” or “Seller” will be shown beside your counterparty’s nickname. |

|

3 Bubble Color |

All messages from Bybit Customer Support will appear in a Bybit Orange chat bubble. |

Depending on the background color, your counterparty’s messages will appear in a Light Peach or Dark Chocolate chat bubble. |

-

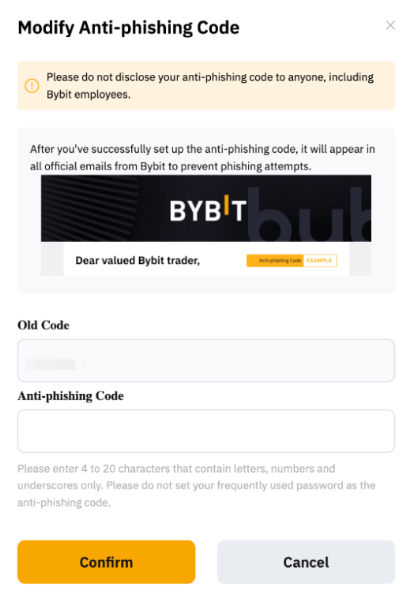

Always set up your unique anti-phishing code from our Account & Security page. This simple step increases account security and allows users to better identify official emails sent by Bybit.

4. Triangle Scams

A triangle scam involves two scammers simultaneously placing orders with the same seller. They exploit the seller's trust and urgency to sell, pressuring them to release coins without proper verification. It can be risky to release funds without verifying who initiated the transfer. If you are not careful, you could release the funds twice but only receive half of the intended amount or less for the assets you’ve sold.

Example

Scammer A makes an order for 2,000 USDT worth of crypto (Order A), and Scammer B makes an order worth 3,000 USDT (Order B). Scammer B then transfers a payment of 2,000 USDT to the seller. At the same time, Scammer A marks Order A as paid. The seller releases the crypto to Buyer A.

Scammer B sends another payment of 1,000 USDT to the seller, along with the payment proof of 2,000 USDT from Order A, and pressures the seller to release digital assets from Order B.

How to Prevent Triangle Scams:

-

Do not accept third-party payments. Always ensure that the payer/payee’s name matches the name provided in Identity Verification on Bybit before making payments and completing the order.

-

Be cautious with proof of payment provided by counterparties, scammers may attempt to reuse them for different orders.

5. Man-in-the-Middle (MitM) Scams

In a MitM scam, a scammer pretends to be a P2P advertiser looking to buy or sell crypto on the Bybit P2P platform. They will contact potential victims through external channels, such as Telegram, WhatsApp, or other social networking platforms. During the conversation, scammers share their bank account information and provide the details about the P2P advertisements listed on Bybit.

Example 1

Scammers may offer a better rate via external channels and ask the victim to open an order on Bybit P2P after the payment is made. For example, scammers may offer to pay 100 USDT in fiat and get 120 USDT.

Example 2

The scammers may provide the victims with their bank account details via external channels. They instruct the victim to confirm the receipt of the account information by copying them into the P2P Order Chat. Unbeknownst to the victim, he inadvertently shares the scammers’ bank account details in the chat with an unrelated buyer, who is also unaware of the scam. The victim then releases his crypto to the unrelated buyer, who unknowingly sends money to the scammers’ bank account.

In such cases, if the victim submits an appeal, the P2P specialists are unable to provide any further assistance since communication with the fraudster occurred outside the Bybit platform.

How to prevent Man-in-the-Middle (MitM) Scams:

-

Only communicate within the P2P Order Chat and refrain from engaging in interactions or transactions outside the platform.

-

Do not accept third-party payments. Always ensure that the payer/payee’s name matches the name provided in Identity Verification on Bybit before making payment and completing the order.

-

Do not trust any offers or information received from external channels.

6. Chargeback/Check Scams

Scammers may take advantage of the chargeback feature on some payment methods to reverse or cancel their initial payment after a P2P order is completed. They might dispute that the transaction was fraudulent or made by mistake in order to reverse the initial payment.

Scammers may also try to complete the payment with a bounced check that can't be cashed or simply cancel the payment after the release of crypto. They can exploit the time delay and uncertainty associated with check payments to their advantage.

How to prevent Chargeback/Check Scams:

-

Do not rush into approving P2P transactions. Always verify that you’ve received the funds before authorizing a crypto transfer.

-

Do not accept any payment by check.

-

Do not accept payments from third-party payments, as they carry a higher risk of chargebacks.

-

If someone insists on paying with a check, consider it a red flag and file an appeal immediately.

7. Cancellation After Payment Completed

Scammers will ask you to cancel your order after payment has been made, citing supposed technical issues as an excuse.

Example

Upon receiving payments, scammers may ask the buyer to cancel the original order, citing alleged technical issues. They would then ask the buyer to place a new order. Once the buyer cancels the initial order, scammers would immediately remove their advertisement from the P2P page, leaving buyers unable to obtain refunds.

How to Prevent Cancel Order Scams:

-

Do not cancel your order after payment is made

-

If you encounter any technical issues with your order, please immediately submit an appeal for further assistance

8. SMS Scams

Scammers may send SMS/text messages to victims posing as banks or wallet apps. These deceptive messages closely resemble authentic notifications from legitimate sources. The messages often falsely claim that the recipients have received a payment from their counterparty.

How to Prevent SMS Scams:

-

Always verify the receipt of funds in your bank account or e-wallet before releasing the funds. Do not blindly trust the text message.

9. Fake Giveaway Scams

Scammers may pretend to host “giveaways” or “bonus campaigns” in the name of Bybit. They often promise free USDT or other tokens if you first transfer a small amount of crypto to “verify your wallet” or to “unlock the prize.” Once the funds are sent, the scammer disappears, and no reward is ever delivered.

How to Prevent Fake Giveaway Scams:

-

Please note that Bybit never requires users to transfer funds in order to receive rewards.

-

Verify all promotions on Bybit’s official website, app, or social media accounts.

-

Avoid clicking on suspicious links or engaging with offers shared through unofficial Telegram groups, WhatsApp chats, or random DMs.

10. Cash in Person Transactions

Scammers may use counterfeit money or obtain payments without releasing their crypto holdings. In such cases, Bybit may not be able to verify transactions, due to a lack of legal proof. Therefore, traders who choose a Cash in Person transaction need to be aware of the potential risk of irrecoverable loss (if any) associated with such cash transactions. For more details, please refer to the Cash in Person Transaction Rules.

How to Protect Yourself From P2P Fraud and Scams

-

Double-check all P2P transactions: Always verify the completion of P2P transactions by checking your crypto wallet or bank account. Do not authorize a crypto transfer until you have personally confirmed the payment. Also, do not rely on the buyer’s proof, as it can be tampered with.

-

Verify the counterparty’s identity: Always ensure that the counterparty’s payment account details match their identity on Bybit. Bybit mandates Identity Verification for advertisers and P2P merchants to create a safe P2P platform for all users as well as to better safeguard users’ assets and resolve any disputes.

-

Use Bybit’s Communication Platform: Keep your conversations with buyers or sellers within the P2P Order Chat. Do not use external communication channels such as Skype, Zoom, Discord, Telegram, WhatsApp, etc. Bybit can better protect your rights when communications take place on our platform.

-

Do not be intimidated by scare tactics: Make it a habit to take screenshots of all interactions and transactions. The documentation serves as essential evidence should you encounter any disputes. Do not be afraid to walk away from a transaction if things start to feel suspicious.

-

Submit an appeal to Bybit’s Customer Support: If you’re unable to reach an agreement, please contact our Customer Support team immediately for assistance. You should always report any suspicious activities.

-

Document Everything: Make it a habit to record all transactions and communication with counterparties meticulously. This documentation plays a crucial role as primary evidence and can help make your case with the P2P platform when filing appeals in case of scams or disputes.

Bottom Line

P2P crypto scams may be on the rise, but there are multiple steps you can take to make sure you do not fall prey to them. Always keep an eye out for third-party transfers, double-check that you have actually received payments before releasing your crypto, and do not let scammers use scare tactics to intimidate you into releasing your crypto holdings.

Finally, be aware that numerous types of P2P crypto scams exist, and new ones continue to emerge. For more information, please visit here.