Why is security deposit required for P2P buyers or sellers?

To enhance the security of P2P trading, users flagged as potential risks through comprehensive system evaluation, as well as those applying to become Verified Advertisers (VA) or Business Advertisers (BA), are required to provide a security deposit. These users must provide the required security deposit amount and successfully freeze the security deposit to continue using P2P advertising rights. In certain circumstances, users might also be requested to provide additional documents for further assessment.

To learn more about depositing security deposit, please refer to this article.

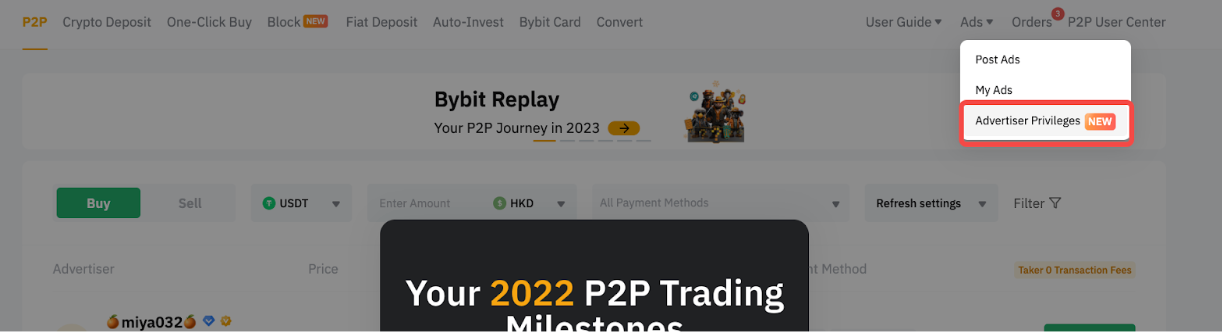

You can also find the required security deposit amount on the Advertiser Privileges page.

Note that only USDT assets are accepted.

How will the security deposit be utilized?

The security deposit will be frozen in your Funding Account. If you need to compensate the counterparty but lack sufficient available assets, the security deposit will be used for compensation during the freezing period.

After the security deposit has been used for compensation, can I still continue to advertise?

If your security deposit was used for compensation and the security deposit balance is less than the required amount, you will immediately lose the permission to post advertisements.

Will my security deposit remain frozen permanently to qualify for posting an advertisement?

For users flagged as potential risks through comprehensive system evaluation, the system will continuously monitor and assess your account performance in real-time. Once your account demonstrates good performance and meets the criteria for unfreezing security deposit, you will be exempt from security deposit freezing. Otherwise, you will need to make the security deposit to qualify for posting advertisements. We would advise you to pay attention to the Security Deposit product interface for specific evaluation results.

For Verified Advertisers (VA) and Block Advertisers (BA), a security deposit must remain in your Funding Account. If you unfreeze the deposit, your advertiser status will be revoked, and you will need to reapply to regain eligibility.

How can I unfreeze my security deposit during the freezing period?

For users flagged as potential risks through comprehensive system evaluation, there are two (2) ways to cancel the freezing of your security deposit.

Method 1: Improve Account Trading Performance (For Users Flagged as Potential Risks)

If your account has been flagged as a potential risk through a comprehensive system evaluation, improving in overall performance may exempt you from having your security deposit frozen. To retain advertising rights without a security deposit, please follow these steps to improve your rankings:

- Avoid arbitrary order cancellations to enhance order completion rates.

- Engage actively and courteously with the counterparty, addressing queries patiently to improve ratings.

- Process orders promptly, expediting coin releases or payments to improve transaction efficiency.

- Enhance the rate of positive comments and reduce the frequency of being reported, appealed, and blocked by other counterparties.

- Adhere to P2P platform trading rules for safe and honest trading practices.

Method 2: Apply to Unfreeze Security Deposit (For Users Flagged as Potential Risks and VAs/BAs)

Users flagged as potential risks and Verified Advertisers (VAs) or Business Advertisers (BAs) can manually apply to cancel the security deposit freeze. For further details on unfreezing security deposits, please visit this article. Please note that the unfreezing of your security deposit entails forfeiting the privilege to publish P2P advertisements.

Note:

- You might be also prompted to submit additional documents when applying for unfreezing the security deposit. You will be alerted via the email notification and system notification when the action is required. Kindly follow the instructions stated on the Security Deposit page. You will receive the result within 48 hours upon document submission.

- You cannot apply for unfreezing if you have orders in progress or under appeal.

- Ensure all orders are processed before applying.

What are the conditions required to unfreeze the security deposit manually in P2P Trading?

To manually unfreeze your security deposit:

- Have no orders in progress or under appeal.

- Ensure all orders are processed before applying.

- Your P2P account must not be identified as potentially risky.

- Be aware that the unfreezing of your security deposit entails forfeiting the privilege to publish P2P advertisements.

How long does it take to unfreeze or withdraw the security deposit?

The processing time for unfreezing or withdrawing the security deposit depends on your advertiser level.

- General, Verified or Block Advertiser: The security deposit will be unfrozen and available for withdrawal immediately after canceling the advertiser status, provided all the above conditions are met.

- Restricted Advertiser: The security deposit will be unfrozen and available for withdrawal 48 hours after canceling the advertiser status. Please head to the P2P Advertiser Program page to manually unfreeze the security deposit after 48 hours.

When unfreezing, will my security deposit still be the original amount?

If you haven't committed any fraud or caused asset losses to the counterparty during the security deposit freezing period, your security deposit will be released in full.

However, in the event of fraud detection, your security deposit will first be used to compensate the counterparty for asset losses and your account will be frozen for 90 days to deal with potential fraudulent loss compensations. Unfreezing can only be applied for after 90 days. If losses occur due to non-fraudulent reasons, the corresponding amount of your security deposit will be used for compensation.

When canceling the freeze, the cancelable margin is the actual security deposit amount. For example, if you freeze 200 USDT and apply for unfreezing because 100 USDT has been used for compensation, the unfrozen amount will be 100 USDT.