Take Profit (TP) and Stop Loss (SL) are ways to manage risk. A TP order allows you to secure profits, especially in volatile markets. Meanwhile, an SL order helps you limit potential losses.

Difference Between TP/SL Order, OCO Order, and Conditional Order

TP/SL orders are similar to Conditional orders, with some differences as follows:

|

Order Type |

Assets Occupancy Status |

|

TP/SL Order |

When a TP/SL order is placed, assets are occupied even before the order is triggered. |

|

OCO Order (One-Cancels-the-Other) |

When placing an OCO order, only one side of the order margin will be occupied due to the nature of the OCO order. For more information, please visit here. |

|

Conditional Order |

When placing a Conditional order, assets will not be occupied until the price of the underlying asset reaches the trigger price. The required assets will be occupied only after the Conditional order is triggered. |

How Spot TP/SL Works

-

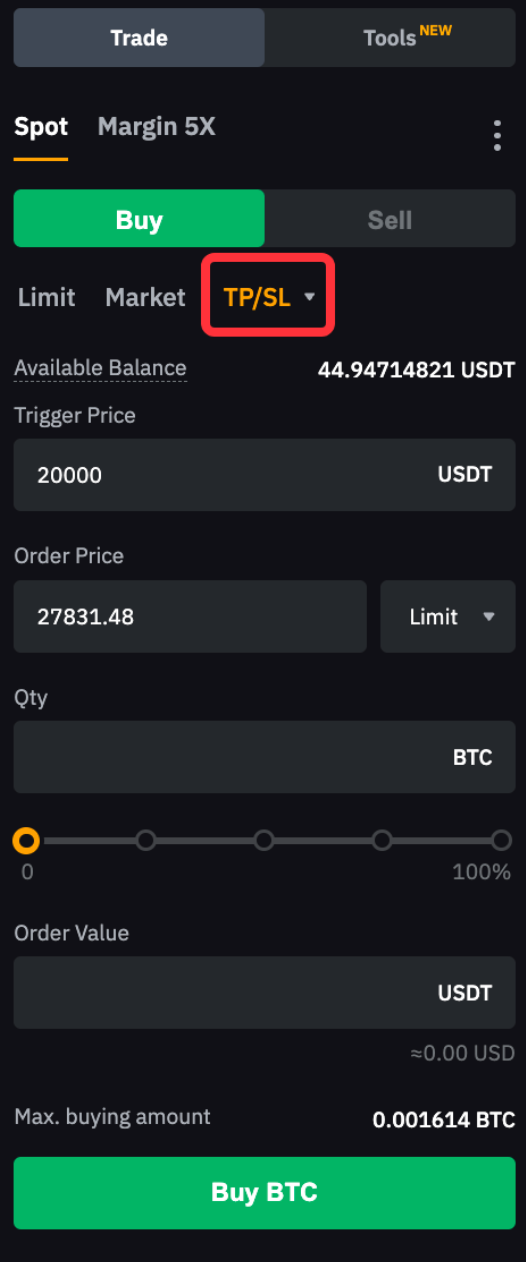

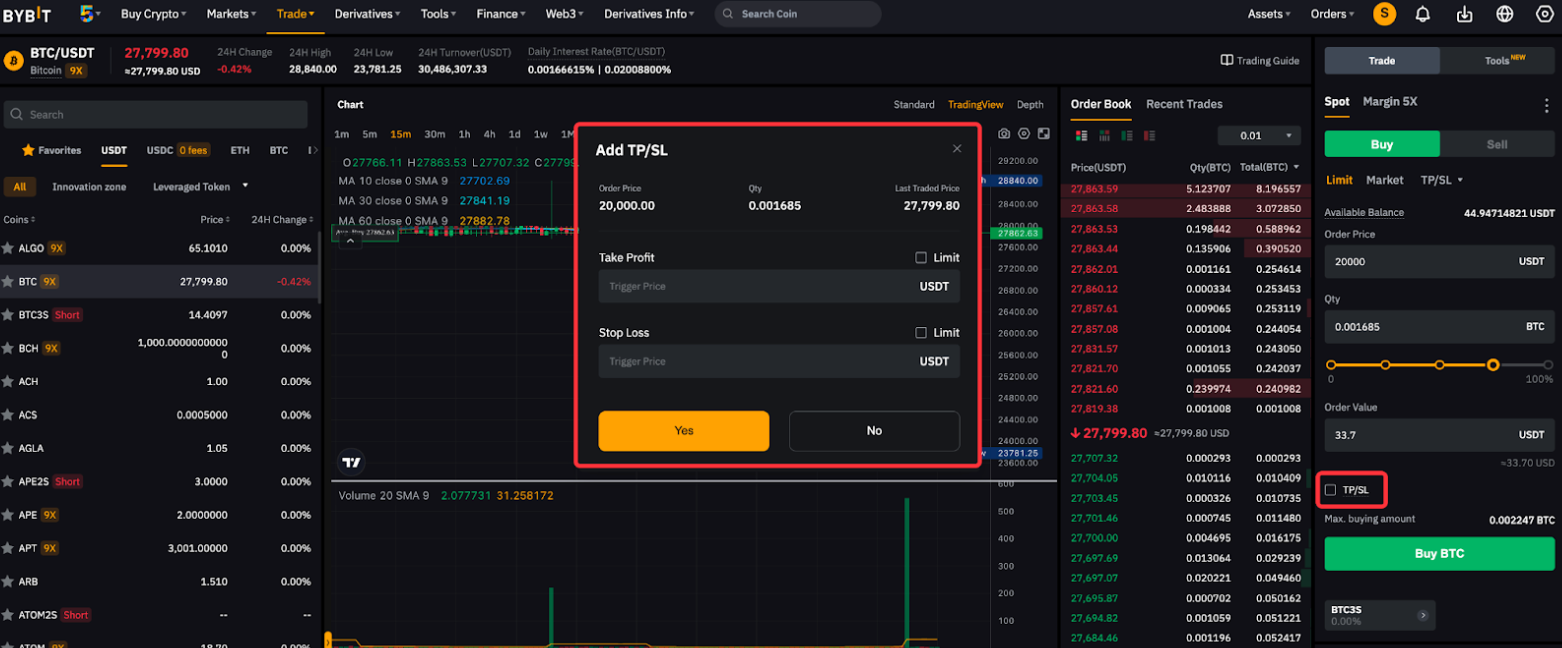

Place TP/SL orders directly from the order zone

|

Web

|

App

|

|  |

You can set the trigger price, order price (Limit order), and order quantity to the TP/SL order. The assets will be occupied at the time when the TP/SL order is placed. Once the last traded price reaches the preset trigger price, a Limit or Market order will be placed according to the present order parameters.

— A Market order will be filled immediately at the best available market price.

— A Limit order will be submitted to the order book and await execution at the specified order price. If the best bid/ask price is better than the order price, the Limit order may be executed immediately at the best bid/ask price. Hence, traders are advised to exercise caution with the non-guaranteed execution of Limit orders, as it is subject to price movement and order book liquidity.

Example

Assuming the current BTC price is 20,000 USDT, here are some scenarios for TP/SL orders with different triggers and order prices.

|

TP/SL Market Sell Order Trigger Price: 19,000 USDT Order Price: N/A |

When the last traded price reaches the TP/SL trigger price of 19,000 USDT, the TP/SL order will be triggered, and a Market sell order will be placed immediately, selling the assets at the best available market price. |

|

TP/SL Limit Buy Order Trigger Price: 21,000 USDT Order Price: 20,000 USDT |

When the last traded price reaches the TP/SL trigger price of 21,000 USDT, the TP/SL order will be triggered, and a Limit buy order with 20,000 USDT order price will be placed into the order book, awaiting execution. Once the last traded price reaches 20,000 USDT, the order will be executed. |

|

TP/SL Limit Sell Order Trigger Price: 21,000 USDT Order Price: 21,000 USDT |

When the last traded price reaches the TP/SL trigger price of 21,000 USDT, the TP/SL order is triggered. Assuming the best bid price is 21,050 USDT after the trigger, the Limit sell order will be executed immediately at a price better (higher) than the order price, which is 21,050 USDT in this case. However, if the price drops below the order price upon triggering, a 21,000 USDT Limit sell order will be placed into the order book for execution. |

-

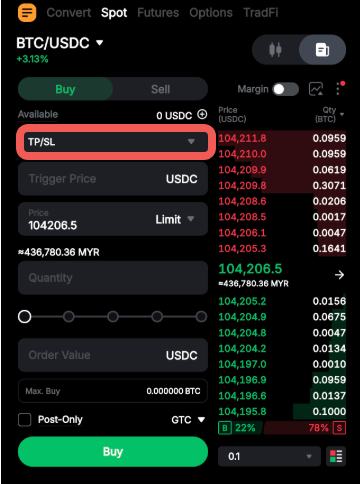

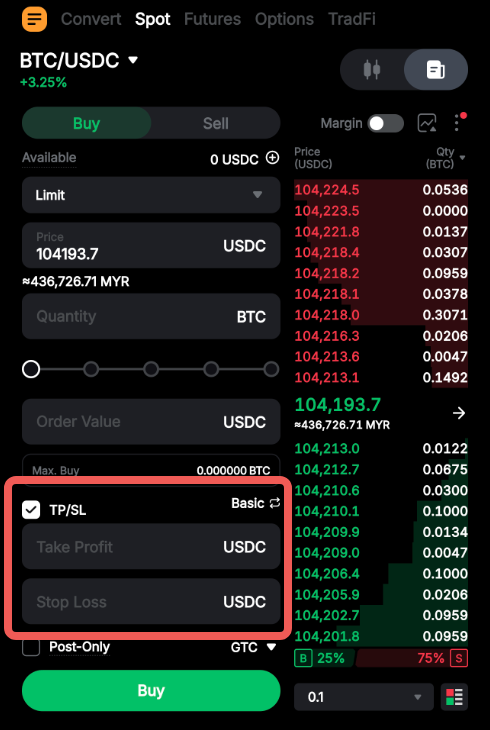

Pre-set TP/SL orders along with Limit order placement

|

Web

|

App

|

|  |

In addition to placing a Limit order, traders have the option to include a set of TP or SL orders. Once the Limit order is executed, the TP and SL orders are automatically placed based on pre-set prices and the specified order quantity.

This approach aligns with the logic of One-Cancel-the-Others (OCO) orders, where only one side of the order margin is occupied. Traders have the option to concurrently place TP and SL orders as either Market or Limit orders for a single asset. The automatic cancellation of one order will trigger the other. However, it's crucial for traders who are placing TP/SL Limit orders to understand that the corresponding TP/SL order will be canceled immediately upon the TP/SL Limit order being triggered, even if the TP/SL Limit order is yet to be filled.

In certain cases, if there is a price rebound, this may result in your TP/SL Limit order price not reaching a level where it can be executed, while the other corresponding order has already been canceled.

Example

Trader A placed a BTC buy Limit order at 40,000 USDT. At the same time, they pre-set a TP/SL on the Limit order as follows:

-

Limit Order Price: 40,000 USDT

-

Order Quantity: 1 BTC

-

Take Profit Limit: Trigger price at 50,000 USDT, order price at 50,500 USDT

-

Stop Loss Market: Trigger price at 30,000 USDT

Assuming the price of BTC reaches 40,000 USDT, the Limit order is filled, and the TP/SL order is placed.

Scenario 1: The price rises to 50,000 USDT. The TP order is triggered, and a Limit sell TP order with a 50,500 USDT order price will be placed into the order book and awaits execution. The SL order is canceled.

Scenario 2: The price drops to 30,000 USDT. The SL order is triggered, and a Market sell SL order will be placed. The 1 BTC will be sold at the best available market price.

Notes:

— For the TP/SL sell order attached to your Spot Limit buy order, the TP trigger price has to be higher than your Limit order price, while the SL trigger price has to be lower than your Limit order price.

— For the TP/SL buy order attached to your Spot Limit sell order, the TP trigger price has to be lower than your Limit order price while the SL trigger price has to be higher than your Limit order price.

— The order price for TP and SL cannot surpass the contract price limit set for the trigger price in a Limit order. For instance, if the price limit for BTC/USDT is 3%, the TP/SL buy order price should not exceed 103% of the trigger price, while the TP/SL sell order price should not fall below 97% of the trigger price. Refer to our spot trading rules for specific price limits on each symbol.

— If the traded amount or value does not meet the minimum order requirement after the Limit order is executed, your TP/SL may fail to be placed or executed upon triggering.

— The maximum order limits for Spot Limit Orders and Market Orders are different. When you try to preset a TP/SL market order along with Limit order placement, if the quantity of the Limit Order exceeds the maximum limit for Market Orders, the order placement will be rejected. For example, if the maximum Limit Order size is 1 BTC and the maximum Market Order size is 0.5 BTC, placing a 1 BTC Limit Order with a TP/SL market order will be rejected, as the maximum size for a market order is 0.5 BTC.