To protect traders from market manipulations, Bybit implements the following order execution limits for Spot and Spot Margin trading.

Price Limit

For Market Order: If the est. filled price of a buy (or sell) order is higher (or lower) than the price limit, the portion exceeding the price limit will be cancelled. Hence, a market order can be fully canceled or partially executed. Furthermore, a market order can only be filled within 10,000 transactions, portions exceeding 10,000 transactions will be canceled.

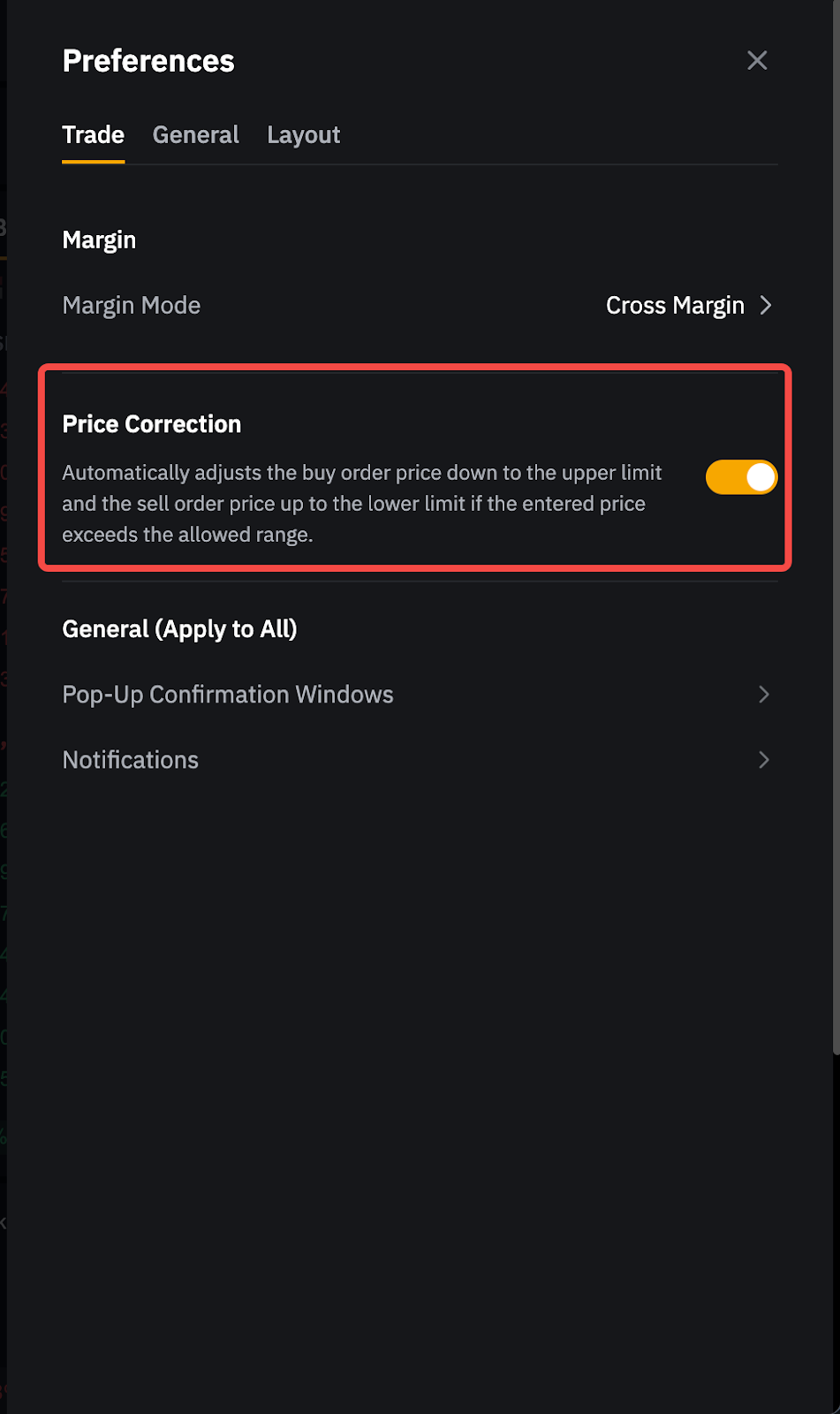

For Limit Order: If the order price of a buy (or sell) order is higher (or lower) than the price limit, the order will be canceled and will not be executed if you have disabled Price Correction settings (by default). If you have enabled the Price Correction settings, the order price of the buy (or sell) order will automatically be adjusted down (or up) to the upper (or lower) limit when the entered price exceeds the allowed range.

Please note that the Price Limit within and after the first five minutes of a new coin listing is different, as stated below.

Other Order Type: Within the first 5 minutes of a new coin listing, Market Orders, Conditional Orders, Stop Loss/Take Profit Orders, OCO Orders, and Strategy Orders will not be supported. After the first 5 minutes, the price limits for orders will follow the rules mentioned above.

Price Limit Calculation

|

Phase |

Maximum Price Limit for Buy Orders |

Minimum Price Limit for Sell Orders |

|

Within the First 5 Minutes of a New Coin Listing |

Opening Price × 100 |

Last Traded Price × (1–5%) |

|

After the First 5 Minutes of a New Coin Listing |

Min[Max(Index Price, Index Price × (1 + x%) + 2-Minute Average Premium), Index Price × (1 + y%)] |

Max[Min(Index Price, Index Price × (1 – x%) + 2-Minute Average Premium), Index Price × (1 – y%)] |

Notes:

— Index Price Calculation can be found here.

— You can view the x% and y% of each trading pair from the Spot Trading Rules page.

— The average premium over the past two (2) minutes will be calculated as follows:

-

Retrieve the past two (2) minutes of Spot second-level trading data and Spot Index data.

-

Calculate the mid-price for each second using the formula: Mid-price = (Best Ask Price + Best Bid Price) / 2.

-

Subtract the spot index price from the mid-price to determine the premium basis for each second.

-

Finally, compute the average of the 120 premium basis values from the past 2 minutes.

— For API Users, please refer to the GET /v5/market/instruments-info, category=spot endpoint for detailed information on the fields: priceLimitRatioX, priceLimitRatioY.

Order Limit

Bybit has set minimum and maximum limits for both the quantity and value of single orders. Specifically, the order value must meet the minimum set, while the order quantity must not exceed the maximum limits. For example, a single BTC/USDT order must meet the following conditions: the minimum order value is 1 USDT and the maximum order quantity is 71.73 BTC.

Limit and Market orders have different maximum order quantities. For RPI and Post-Only orders, the maximum limit is five times the maximum order quantity of a Limit order. These parameters are periodically adjusted based on Bybit's risk management requirements. For specific updates, please refer to the official spot trading rules.

Order Quotas

An order quota refers to the maximum value of coins a user can hold after buying from the Spot market. The available quota for the selected coin = max. total order value - no. of coins held (Unified Trading Account) * last traded price - current total order value.

Only the coins listed in the Adventure Zone are subject to order quota due to the higher investment risk and price volatility. There is no limit on coins outside these zones.

For illustration, the order quota for MVL is 300,000 USDT, and the market price is 0.002640. The maximum quantity users can buy from the Spot market is 113,636,363 MVL (300,000/0.002640). Once this quota is reached, only sell orders are allowed. Any value increase due to deposits or price changes after reaching the quota isn't restricted. You can view the order quotas on the spot trading order window.

How to View the Spot Trading Limit

To view the price limit and order limit for the respective spot trading pair, please visit this page.