Understanding the rules and guidelines for Copy Trading Pro is crucial for both Pro Masters and Investors. This guide provides detailed instructions on strategy creation, seed round requirements, lock-up phases, subscription and redemption windows, and strategy termination.

- Overview

- Strategy Creation and Seed Round

- Lock-up Phase

- Strategy Maturity and Settlement

- Strategy Termination

Overview

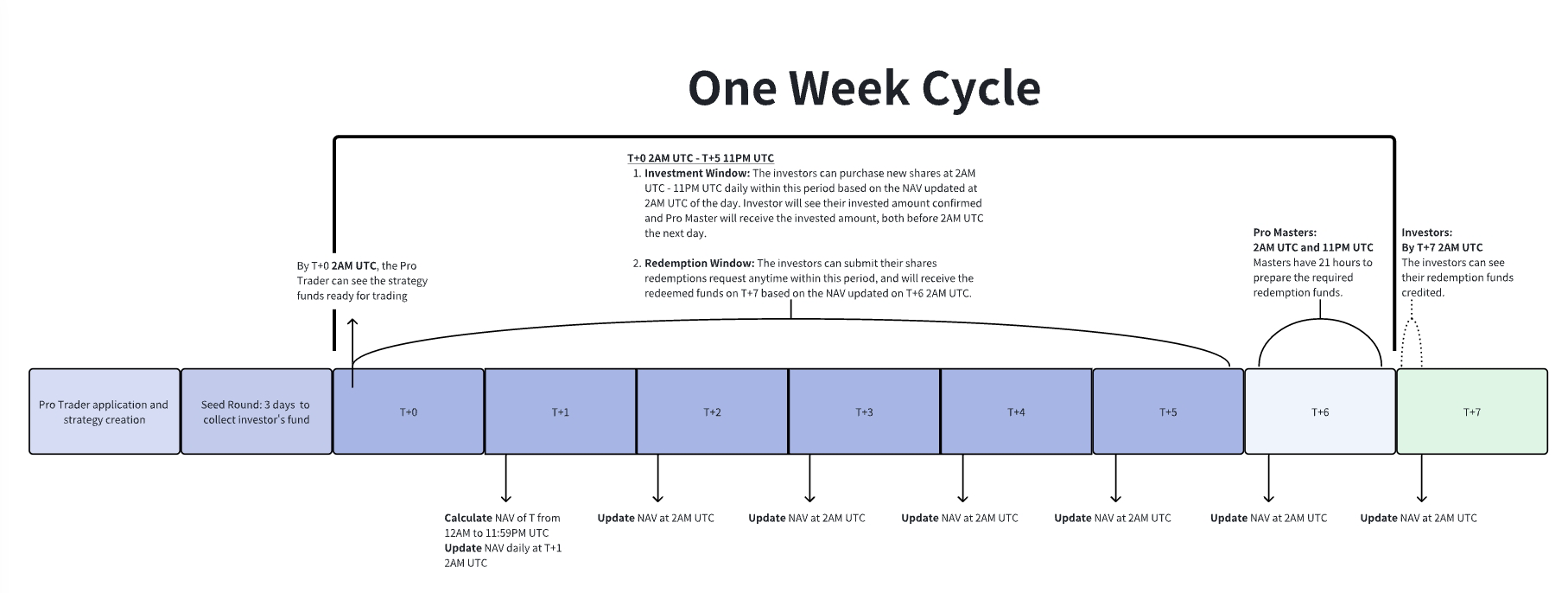

Before diving into each cycle, let’s examine the overall timeline for Copy Trading Pro. This overview provides a foundational understanding of each phase.

-

“T” marks the strategy’s launch date and the beginning of the lock-up phase. This date is not tied to a specific weekday.

-

Suppose “T” lands on a Monday: Investors can purchase additional shares between 2 AM UTC and 11 PM UTC from Monday to Saturday. To redeem shares, investors may submit redemption requests anytime from 2 AM UTC on Monday until 11 PM UTC on Saturday. The Pro Master sorts out the necessary redemption funds on Sunday, and by the following Monday, the funds are credited to the investors' accounts.

Different Period Timeline

|

Fundraising Period |

Strategy Launch Date / Lock-up Start Date |

Redemption Window |

Subscription Window (2 AM - 11 PM UTC) |

|

Mon – Wed |

Thu |

Thu - Next Tue |

Thu - Next Tue |

|

Tue – Thu |

Fri |

Fri - Next Wed |

Fri - Next Wed |

|

Wed – Fri |

Sat |

Sat - Next Thu |

Sat - Next Thu |

|

Thu – Sat |

Sun |

Sun - Next Fri |

Sun - Next Fri |

|

Fri – Sun |

Next Mon |

Next Mon - Next Sat |

Next Mon - Next Sat |

|

Sat – Next Mon |

Next Tue |

Next Tue - Next Sun |

Next Tue - Next Sun |

|

Sun – Next Tue |

Next Wed |

Next Wed - The Monday after the following week |

Next Wed - The Monday after the following week |

Note: All timelines stated above are in the UTC time zone.

Strategy Creation and Seed Round

Pro Master Guidelines

-

Applying to Be a Pro Master and Creating Your Strategy

-

Activate Your Account: Ensure you meet the requirements to apply as a Pro Master and apply using your Main Account. Refer to How to Apply as a Pro Master for more information.

-

Create Strategy: Use your Pro Master Subaccount to create a strategy once approved. Set the parameters and ensure the required minimum master balance is available in the Funding Account of your Main Account. Strategy creation may take one (1) to three (3) working days.

-

Entry to Seed Round:

-

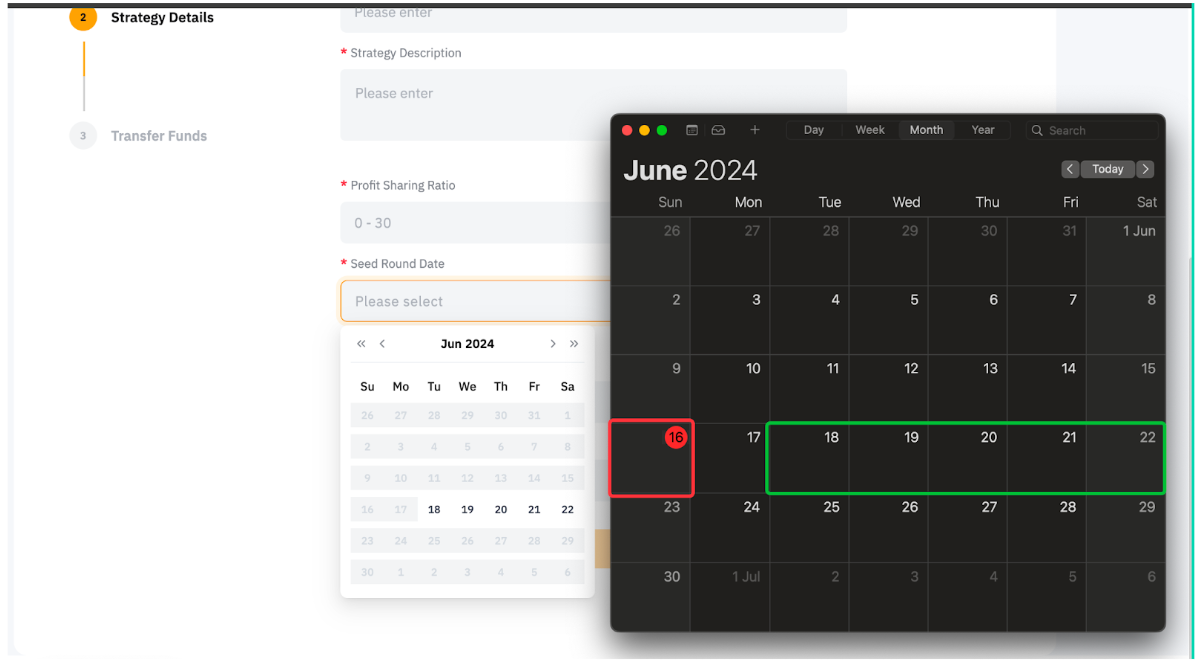

Seed Round Start Date: Choose from the nearest five (5) available dates, starting two (2) days after strategy creation. The Seed Round is a 3-day fundraising phase for Investor contributions.

Example

-

Strategy Creation Date: Jun 16, 2024

-

Available Fundraising Dates: Jun 18, 2024, to Jun 22, 2024

-

Selected Date: Jun 19, 2024

-

Seed Round: 12AM UTC on Jun 19, 2024, to 11:59PM UTC on Jun 21, 2024.

-

Strategy Launch: 2AM UTC on Jun 22, 2024.

-

Strategy Types and Limits

|

Stable |

Aggressive | |

|

Max. Leverage |

5x |

10x |

|

Min. Master Balance |

10% |

15% |

|

Strategy Value Cap (Actual cap depends on user’s selection on total share limit) |

5 million |

1 million |

|

Trade Type |

Spot Only or Hybrid (Derivatives + Spot) |

Hybrid (Derivatives + Spot) |

Example

If selecting "Aggressive":

-

Max. leverage: 10x

-

Total Share Limit Options: 100,000, 500,000 or 1 million

-

Min. Master Balance Ratio: 15% (15,000 USDT, 75,000 USDT, or 150,000 USDT)

The minimum master balance ratio will be adjusted based on the selected total share limit. If Pro Master has selected a 1 million share limit, the minimum master balance that needs to be invested by Pro Master will be 150,000 USDT, calculated using the initial NAV = 1. Pro Master’s invested amount cannot be redeemed during the trading period unless the strategy is terminated.

After successfully creating the strategy, the Pro Master can still raise the share limit during the investment window. When the Pro Master chooses to increase the capacity, they must also contribute the corresponding additional Master Balance to complete the expansion successfully.

Investor Guidelines

As an Investor, you can purchase shares during the initial seed round phase or the weekly investment window, as stated in the investment rules of the Pro Master’s strategy.

During the initial seed round period, the Net Asset Value (NAV) of shares is 1.00, meaning the initial investment amount directly converts to an equivalent share amount at a 1:1 ratio. Your minimum and maximum investment amounts are as follows, depending on the Pro Master Settings:

|

Investment Amount Type |

Range |

|

Minimum Investment |

$200 – $10,000 |

|

Maximum Investment |

$11,000 – $100,000 |

Lock-up Phase: Trading Period, Subscription and Redemption Window

Trading Period

Pro Master Guidelines

The Pro Master can utilize strategy funds from Investors' subscriptions and their own balance, credited to the Unified Trading Account (UTA), to start trading. Copy Trading Pro supports Spot, USDT Perpetuals, and USDC Perpetuals trading. The Pro Master is restricted from trading products and services that are not mentioned.

Investors Guidelines

Once the trading period begins, Investors' funds will be entrusted to the Pro Master for trading. Investors can view the shares’ NAV updated daily at 2AM UTC. NAV reflects the value of shares which is influenced by the changes in the Pro Master's equity. As equity grows, under a fixed share amount, NAV increases accordingly.

Investment Window

The running strategy will open for subscription six days a week, anytime between 2 AM UTC and 11 PM UTC from T+0 to T+5.

Pro Master Guidelines

Trading activities of Pro Masters remain unaffected during the Investment window period.

Investor Guidelines

-

Investment window: anytime between 2 AM UTC and 11 PM UTC from T+0 to T+5.

-

The subscription shares are calculated based on the NAV updated at 2 AM on the day of investment.

-

For example, an investor invests in a Copy Pro strategy at 4 AM UTC on T+1. Her confirmed investment will be reflected before 2 AM UTC on T+2, based on the NAV updated at 2 AM UTC on T+1. If the NAV of the shares is 1.5, with an invested amount of 12,000 USDT, the investor will get 8,000 (12,000 / 1.5) shares.

-

The total subscription shares for the strategy cannot exceed the total share limit. Partial subscription will fail if exceeded.

Investment Example

Scenario 1: Normal Subscription

Strategy A Details:

-

Entered the Lock-up Phrase on Jun 10 (Monday)

-

Initial NAV = 1.00

-

Initial raised shares = 500,000 / 1,000,000 (Trader holds 10%, i.e., 100,000)

Process:

-

At 2AM UTC on Jun 15, 2024 (Saturday):

-

Purchased shares = 500k

-

NAV = 1.2

-

Account Equity = $600,000 (Available Balance: $100,000 + Position Net Value: $500k)

-

-

Investment Window (2AM UTC - 11PM UTC):

-

Investors initiate subscription values totaling 120,000 USDT.

-

Total new shares purchased = 100K shares (120,000 / 1.2)

-

The system will transfer 120,000 USDT to Pro Master A’s Funding Account, then to the UTA.

-

-

Net Asset Value Calculation:

-

Scenario 1 (Position Value Unchanged):

-

Position value and available balance in USDT remain unchanged.

-

Net assets at the end of Jun 15 = $720,000 ($500,000 + $100,000 + $120,000).

-

NAV updated at 2AM on Jun 16 = 1.2 ($720,000 / 600,000 shares).

-

-

Scenario 2 (Position Value Changes):

-

Position Value reduced to $400,000, available balance in USDT unchanged.

-

Net assets at the end of Jun 15 = $620,000 ($400,000 + $100,000 + $120,000)

-

NAV updated at 2AM on Jun 16 = 1.0333 ($620,000 / 600,000 shares)

-

-

Scenario 3 (Subscription Exceeds Total Share Limit):

-

-

At 1PM UTC: Investor A initiates a subscription totaling 540,000 USDT.

-

Converted share = 450,000 (540,000 / 1.2).

-

Remaining share estimate = 50,000 (500,000 - 450,000).

-

-

At 2PM UTC: Investor B initiates a subscription investing 75,000 USDT.

-

Converted share = 62,500 (75,000 / 1.2).

-

Investor B's subscription fails as the available share allocation is <50k.

-

Redemption Window and Processing Phase

Investor Guidelines

-

Redemption Window: From T+0, 2AM UTC to T+5, 11PM UTC weekly,

-

Investors can redeem their purchased shares during the redemption window. Regardless of when the redemption request is submitted, the redemption amount will only be processed on T+6, based on the NAV of T+6, 2 AM UTC.

-

However, if Pro Master fails to prepare adequate redemption funds on time, system takeover and liquidation of Pro Master’s position will be triggered. The redemption amount will then be calculated based on the NAV T+7, 2AM UTC instead.

-

Pro Master will prepare the required redemption funds for the Investors during the period of T+6, 2AM UTC to 11PM UTC. The redemption amount will then be credited to your Funding Account at T+7, 2AM UTC.

-

Once the share redemption request is submitted, it cannot be canceled.

Redeemable Shares:

-

Shares must be held for more than four (4) calendar days before they can be redeemed.

-

Maximum redeemable shares: Sum of all shares held for more than four (4) calendar days.

-

Order of redeeming shares: FIFO (First In, First Out) principle.

Pro Master Guidelines

During the redemption processing phase, the Pro Master can continue trading as usual. However, the trader's dashboard will show the estimated redemption funds (calculated using the confirmed NAV at T+6 2AM UTC). The Pro Master can use the available balance in the UTA or reduce positions to prepare the redemption funds.

Redemption Manual Processing:

-

Settlement Window: T+6, 2AM UTC - 11PM UTC weekly.

-

NAV used for settlement: T+6, 2AM UTC.

-

Shares to be redeemed are fixed during this period.

-

Before 11PM UTC, Pro Master will need to ensure that there are sufficient funds and transfer the available USDT for redemption to the Pro Master's Funding Account.

-

If funds are sufficient but are not ready in the Funding Account, the system will auto-transfer the funds out to the Funding Account for redemption and the T+6 NAV will be used for redemption amount calculation.

Auto Settlement:

-

Settlement Window: T+6, 11PM UTC to T+7, 12AM UTC

-

If funds are insufficient even after the active orders are canceled, the system takes over to impose transaction bans and auto-settlement triggers.

-

Auto Settlement Process:

-

Liquidation of Positions: During automatic settlement, the system will select all contracts and liquidate a specific percentage of positions within each contract in the Pro Master's strategy. The percentage of liquidation is based on the proportion of the Pro Master's assets needed to cover the redemption amount. For example, if 50% of the Pro Master's assets are required, then all contracts sizes will be reduced by 50% to meet the redemption needs.

-

Inability to Meet Redemption Requirements: If automatic settlement is not able to cover the redemption amount due to sudden market changes or excessively risky positions, the system may force the strategy to close entirely to protect existing investors.

-

The NAV on T+7, 2AM UTC will be used for auto settlement.

Redemption Settlement Example

Strategy A Details:

-

Lock-up phase starts on Jun 10, 2024 (T+0).

-

Initial NAV = 1

-

Initial raised shares = 500k / 1,000,000 (Trader holds 10%, i.e., 100,000)

Scenario 1: Manual Settlement

At 2AM UTC on Jun 16 (T+6):

-

Fund shares = 600k / 1,000,000 (including new subscriptions)

-

NAV at T+6, 2AM UTC = 1.2

-

Account net assets = $720,000 (Available Balance: 120,000 USDT + Position Net Value: $600,000).

-

Total redemptions totaling 200,000 shares, redemption funds = 240,000 USDT (200K × 1.2)

-

Pro Master will need to cancel the active order or reduce the position to prepare an extra 120,000 USDT and transfer out a total of 240,000 USDT to Pro Master’s Funding Account before 11PM UTC on Jun 16.

Scenario 2: Auto Settlement

If Pro Master has insufficient funds to cover the redemption funds

-

The system will take over the Pro Master’s account and liquidate the position for redemption funds.

-

Redemption funds required will be based on the NAV calculated at 2AM UTC on Jun 17 (T+7).

Strategy Maturity and Settlement

The strategy matures in 180 days for regular settlement and the final settlement occurs on the 182nd day.

Note: Upon strategy maturity, the strategy will automatically be extended by 175 days. However, Pro Masters can still apply to terminate the strategy if desired.

For Investors:

Investors holding remaining shares will receive their investment principal and any accrued profits or losses.

For Pro Masters:

Pro Masters will receive their invested balance plus any accrued profits or losses.

Strategy Termination

Manual Termination

-

Pro Masters can apply for manual termination of the strategy starting from the 5th week to the 25th week of the Lock-up Phase.

-

Once the strategy termination process is successfully initiated, redemptions for all users will be processed at the next redemption settlement time.

-

During the redemption settlement period, manual strategy termination will not be supported.

Conditions for Strategy Termination

Your strategy termination application will be processed only if all the following conditions are met:

-

No open derivative positions

-

No non-USDT spot holdings

-

No open orders

-

No unsettled funds

Failure to meet these conditions may result in an unsuccessful fund closure. If the strategy termination process fails, a new request must be submitted to proceed.

Auto Termination

Pro Master’s strategy will be auto-terminated in the two (2) scenarios below:

-

Strategy NAV < 0.3: The strategy will be automatically terminated if the NAV falls below 0.3.

-

Unable to Fulfill Redemption Funds: If redemption funds cannot be fulfilled even after engaging in auto settlement.

Please note that notifications will be sent to both the Pro Master and their Investors in the following scenarios, but these will not cause immediate auto termination:

-

Liquidation in UTA, but NAV ≥ 0.3: The strategy has undergone liquidation in UTA, but the NAV is still 0.3 or higher.

-

24h Drawdown ≥ 30%, but NAV ≥ 0.3: The 24-hour drawdown is 30% or more, but the NAV remains 0.3 or higher.

-

Historical Drawdown ≥ 70%, but NAV ≥ 0.3: The historical drawdown is 70% or more, but the NAV is still 0.3 or higher.

-

UTA MMR ≥ 90%, but NAV ≥ 0.3: The Maintenance Margin Ratio (MMR) of the UTA reaches or exceeds 90%, but the NAV remains 0.3 or higher.