How to Activate a Dynamic Delta Hedge Strategy

To activate DDH on Bybit, follow these steps:

Step 1: Access the Dynamic Delta Hedging feature from our Options trading page.

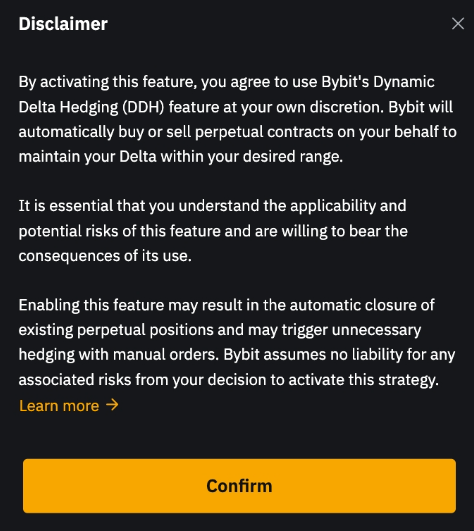

Step 2: Click on Dynamic Delta Hedging to initiate the feature. Before doing so, please carefully review the disclaimer to understand the risks associated with DDH.

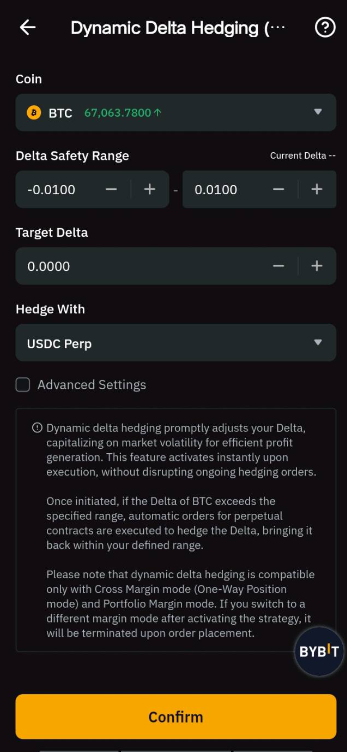

Step 3: Customize your DDH strategy using the following parameters:

-

Coin: Select your desired underlying asset.

-

Delta Safety Range: This represents the range of Delta you can tolerate. If the Delta of a coin exceeds the upper threshold or falls below the lower threshold, the strategy initiates Delta hedging. Importantly, if the Delta returns to within the safe range while placing a Delta-hedging order, the order proceeds to execution instead of being canceled.

-

Hedging Target: Specify the Delta value you aim to achieve when the DDH strategy is triggered.

-

Hedge With: Choose whether to buy USDT or USDC Perpetual to hedge your Options contract. Currently, all order types are executed as Market orders. In the event of extreme market conditions where liquidity diminishes, unfilled orders will be automatically canceled, ensuring no duplication of orders occurs.

-

Advanced Settings (Optional):

This configuration is designed to abstain from executing Delta hedging when the price fluctuation of the underlying asset over a specified period falls below a certain proportion. This approach helps prevent unnecessary delta adjustments triggered by parameter changes like implied volatility, thereby reducing the frequency of hedging activities and associated transaction costs. For instance, if the volatility observed within one (1) hour is below 1%, delta hedging will not be initiated.

-

Trigger Duration: Set the duration for triggering Delta hedging.

-

trigger amplitude: Define the volatility threshold for initiating Delta hedging.

Then, click on Confirm. Once the DDH strategy is enabled, you have the option to modify the parameters of the strategy.

Notes:

— During periods of low volatility, Delta changes may not accurately reflect market conditions. You have the option not to hedge Delta in such cases.

— The reference volatility percentage is calculated as (highest price - lowest price) / lowest price within the last six (6) minutes.

To view the Tools History and orders placed via DDH strategy, you can go to the Tools History page and select DDH strategy type.

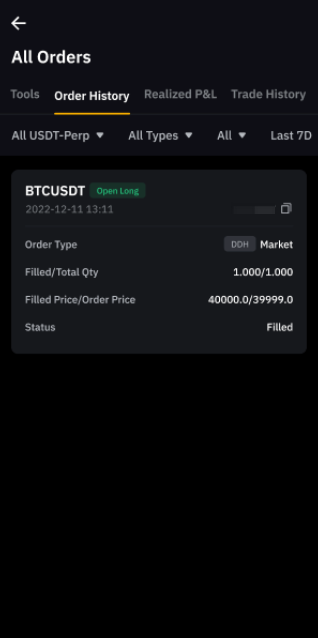

You can see the orders with DDH labels from the Perpetual Order History page.