Bybit Margin Staked SOL is a cutting-edge product that allows you to seamlessly maximize your SOL earnings through leveraged borrowing and staking. Here's a step-by-step guide to help you get started.

View the APR Chart

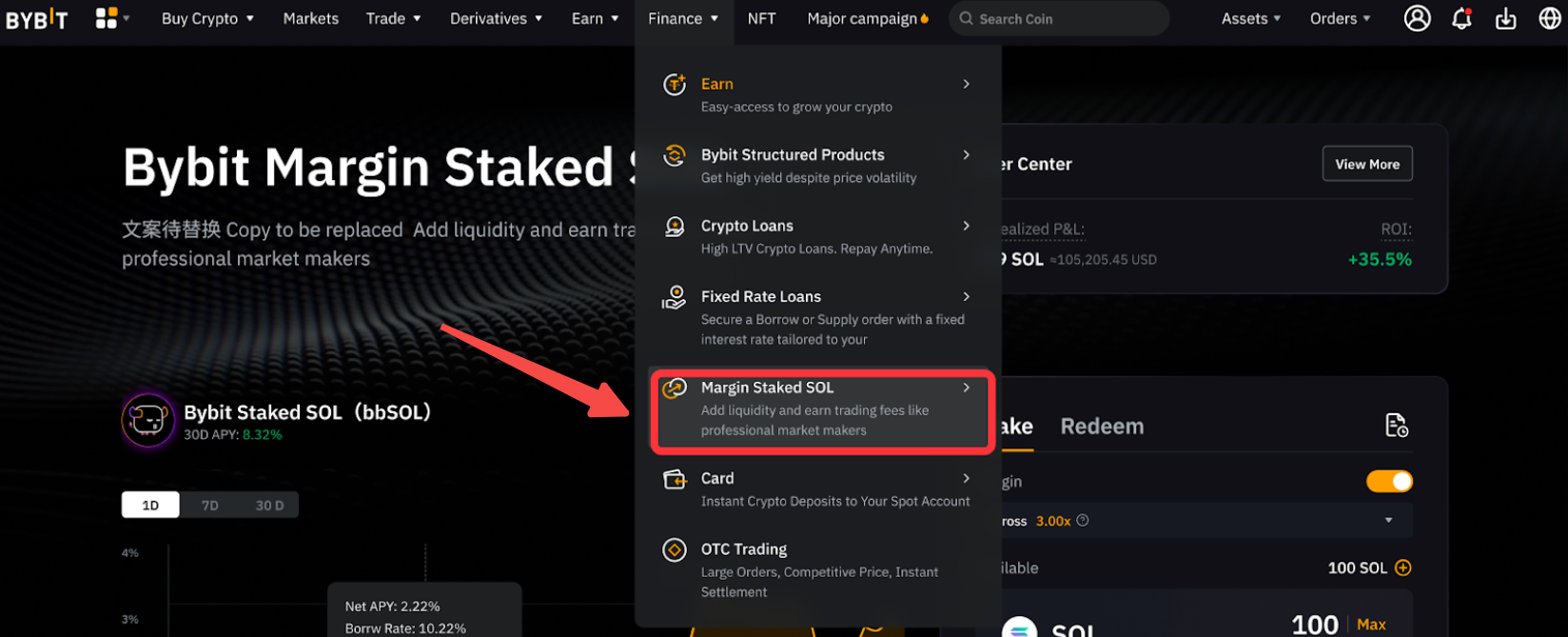

Step 1: Click on Finance → Margin Staked SOL in the navigation bar to access the Margin Staked SOL page.

Step 2: On the left side of the page, you'll find the APR chart, which provides the following information:

-

Net APR: The APR that reflects the earnings from staking after considering borrow rates. It fluctuates based on borrow rates, token prices, and staking rewards.

-

1D / 7D / 30D View: The Net APR trend over the past 1, 7, or 30 days.

-

High: The highest Net APR recorded within the selected timeframe.

-

Low: The lowest Net APR recorded within the selected timeframe.

Step 3: Hover over the APR chart to view the Net APR, Borrow Rate, and SOL APR at any specific point in time.

Notes:

— A positive Net APR is displayed in green, while a negative Net APR is in red.

— Data updates every hour.

Stake Your SOL

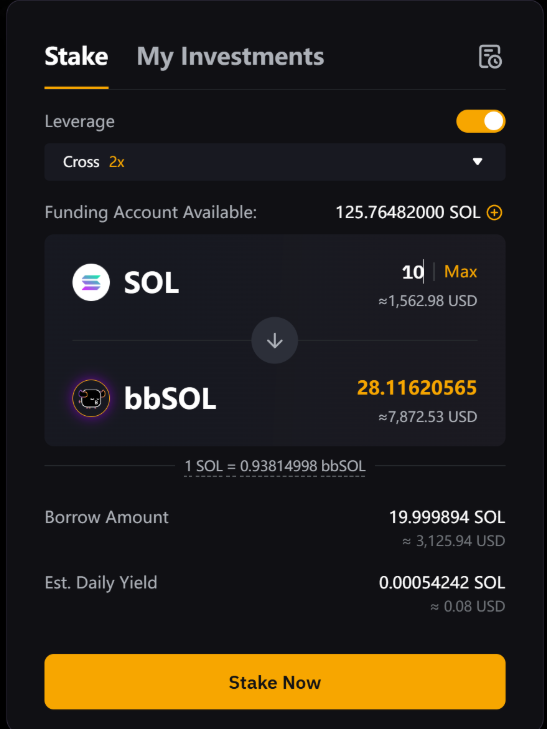

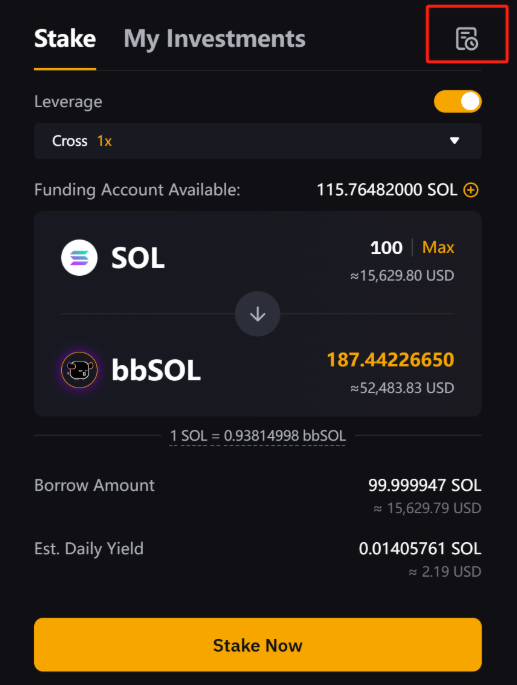

Step 1: On the right panel of the Margin Staked SOL page, set up your staking order based on the following information:

|

Leverage |

Enable it to borrow funds with a leverage of up to 2x, or disable it to stake only your principal. It is turned on by default. |

|

Funding Account Available |

Your SOL balance in the Funding Account. Click the plus (+) icon to transfer SOL from your UTA. |

|

SOL |

The amount of SOL to stake. Click Max to stake your full available balance. |

|

bbSOL |

The expected amount of bbSOL you'll receive, calculated based on your leverage, staked SOL, and the real-time exchange rate between SOL and bbSOL. |

|

Borrow Amount |

The amount of SOL you'll borrow, determined by your principal, selected leverage, and applicable fees.

Borrow Amount = (Principal − Fees) × Leverage |

|

Est. Daily Yield |

Your estimated net daily yield, factoring in staking rewards, borrowing costs, and fees. The actual yield may vary slightly. |

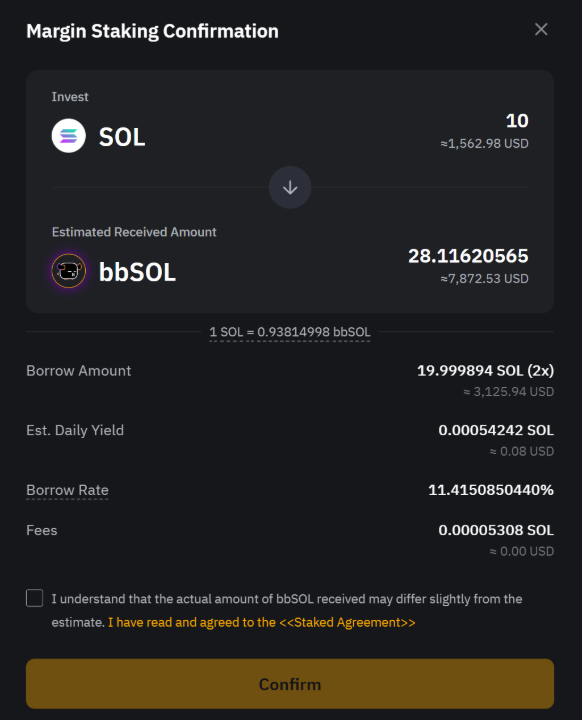

Step 2: Click Stake Now, and a confirmation pop-up will appear. Verify all details before proceeding.

Step 3: Check the acknowledgment box, click Confirm, and you're all set!

Notes:

— If Leverage is disabled, Borrow Amount and Borrow Rate won't be displayed. Your last-used settings will be remembered.

— Margin Staked SOL uses a mechanism to limit losses based on P&L. If your P&L(%) falls to or below the Margin Call P&L(%), the system will notify you to either pledge more SOL into your positions to increase your SOL principal or redeem them. If your P&L(%) drops further to or below the Stop-Loss P&L(%), your positions will be automatically redeemed to cover your loan and interest.

— The default Stop-Loss P&L(%) is set to -90%. You can adjust the Stop-Loss settings on My Investments page.

Redeem Your SOL

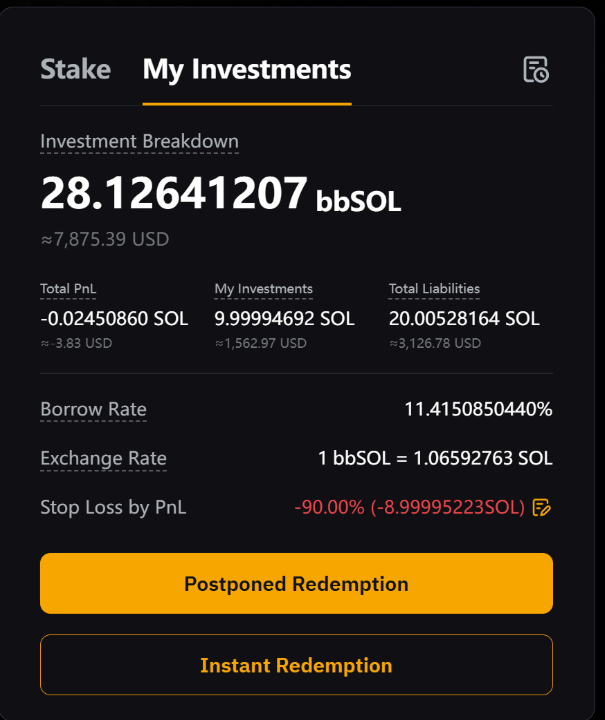

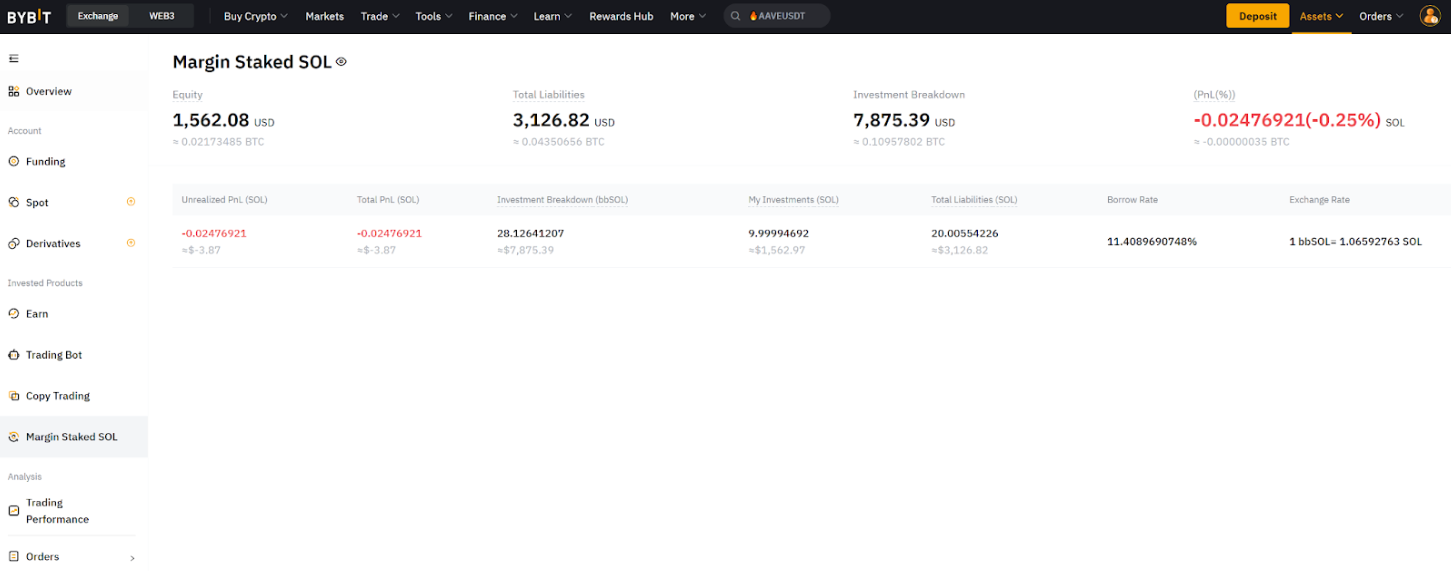

Step 1: On the right panel of the Margin Staked SOL page, click My Investments to view the following details:

|

Investment Breakdown |

Your total bbSOL holdings from both your own funds and borrowed funds. |

|

Total P&L |

The sum of realized and unrealized P&L. |

|

My Investments |

Your own funds, excluding any borrowed funds. |

|

Total Liabilities |

Your total liabilities, including outstanding principal and outstanding interest. |

|

Borrow Rate |

A floating interest rate on borrowed funds, updated hourly. You can check it in the Margin Staking Confirmation pop-up or in your history.

Hourly Interest = Borrow Amount × Hourly Interest Rate

For more details, please refer to FAQ — Margin Staked SOL. |

|

Exchange Rate |

The real-time conversion rate between bbSOL and SOL. |

|

Stop Loss by P&L |

Click the pencil icon to adjust your Stop-Loss settings. Choose Confirm to save your changes or Cancel to discard them. |

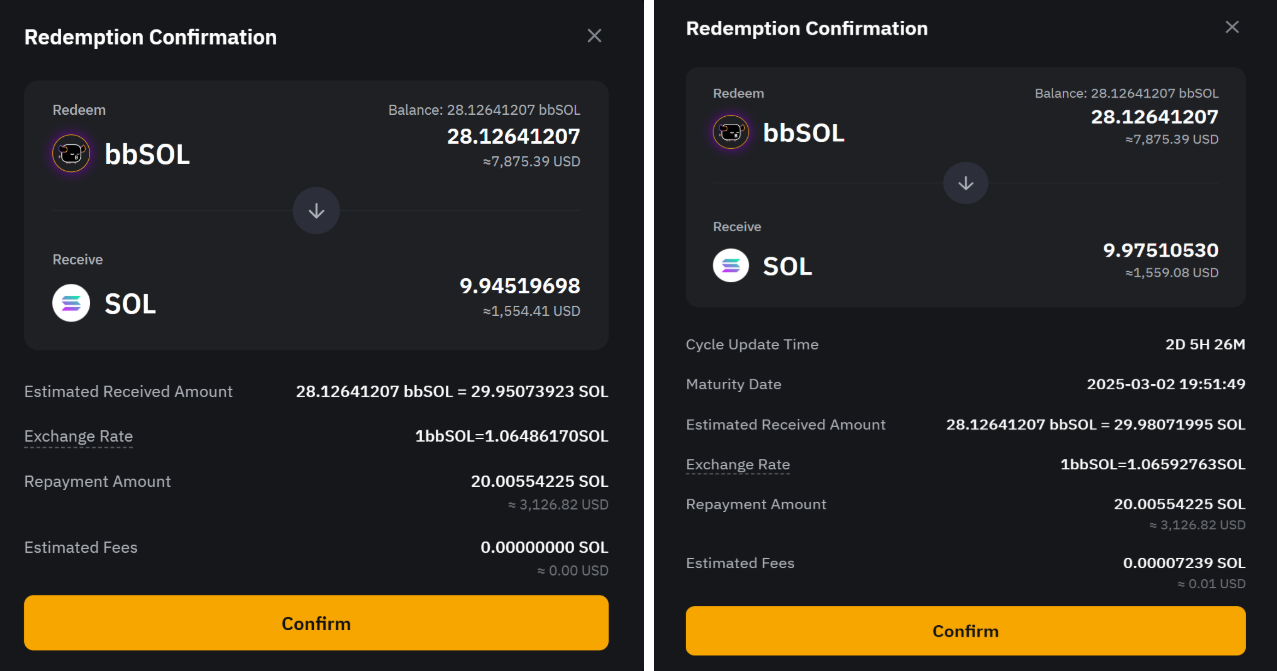

Step 2: Click either Instant Redemption or Postponed Redemption.

-

Instant Redemption: Receive your full principal and part of your earnings immediately. You may lose up to 10% of your earnings.

-

Postponed Redemption: Get your full principal and all earnings after a 1‒4 day processing period, during which interest will continue to accrue. Your bbSOL will be converted to SOL at the real-time exchange rate when you submit your redemption request.

Step 3: A confirmation pop-up will appear. Enter the amount of bbSOL you wish to redeem or click Max to redeem your full balance. The system will automatically calculate the total SOL you'll receive based on the real-time exchange rate, as well as the final amount after deducting loan repayment and any applicable fees. Review the details carefully, then click Instant Redemption or Postponed Redemption to proceed.

Step 4: In the Redemption Confirmation pop-up, double-check the details and click Confirm to finalize your redemption. Your SOL will be credited to your Funding Account.

Notes:

— Instant Redemption is subject to a daily limit set by the platform. There is no limit on Postponed Redemption.

— No manual repayment is required. The system automatically handles repayments when:

-

assets are redeemed, or

-

a stop-loss is triggered.

Additional fees, including gas fees, may apply during this process.

— Staking, redemption, and gas fees apply to Margin Staked SOL orders. For more details, please refer to FAQ — Margin Staked SOL.

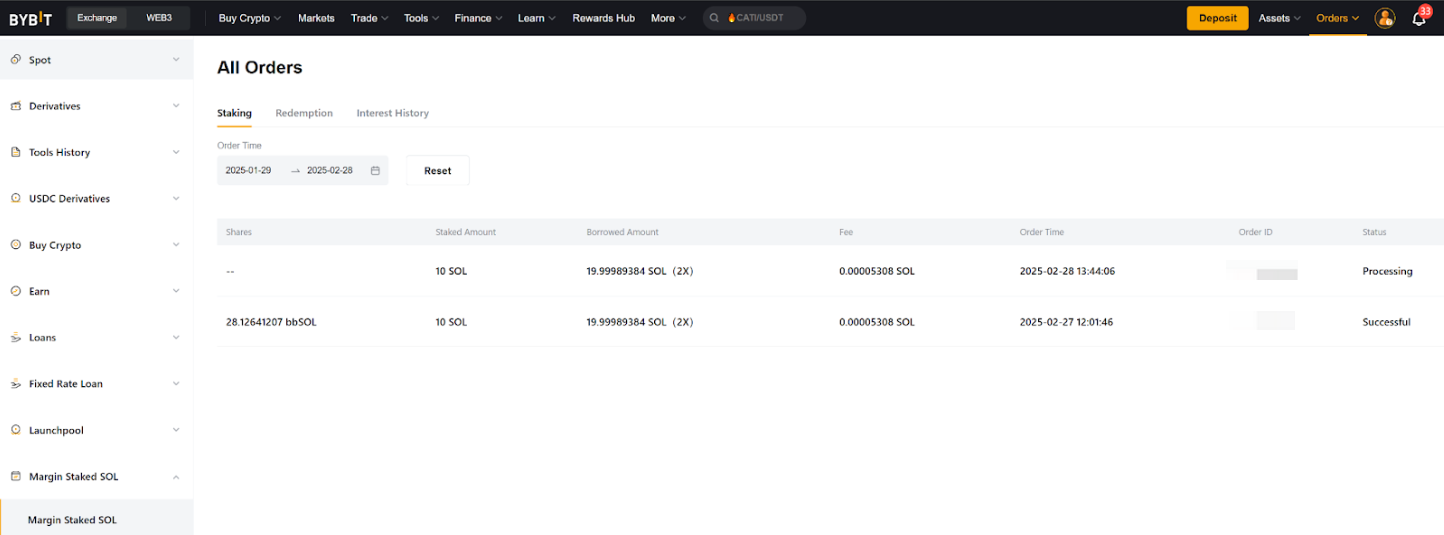

View Your Orders

Step 1: To check your orders, click the history icon in the top-right corner of the Stake or My Investments panel on the Margin Staked SOL homepage.

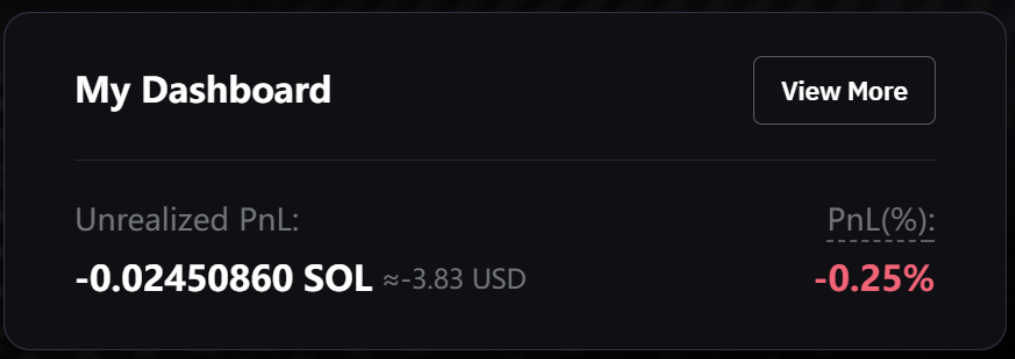

Alternatively, go to My Dashboard in the upper-right corner of the Margin Staked SOL homepage. Here, you'll see your Unrealized P&L and P&L(%). Click View More for detailed order information.

Step 2: On the Margin Staked SOL Orders page, you'll find more details under Staking, Redemption, and Interest History.

Alternatively, on the Margin Staked SOL Assets page, you’ll get an overview of your P&L, liabilities, etc.

For more information on the Margin Staked SOL, please refer to the following articles: