What is Bybit Smart Leverage?

Smart Leverage is a non-principal-protected structured product designed to help users navigate extreme market volatility by allowing them to place bets in a single direction with maximum leverage while mitigating the risks of liquidation within a specified period. It's tailored for high-leverage traders to avoid liquidation risks before settlement.

Who is Smart Leverage suitable for?

Smart Leverage is ideal for:

-

High Leverage: Users who seek high leverage (up to 200x for specific contracts).

-

No Liquidation Before Settlement: Those who want to avoid liquidation before settlement.

-

Early Redemption: Individuals who prefer the option of early redemption.

When should one consider using Smart Leverage?

Optimal Usage Scenarios:

-

In V-shaped markets.

-

For traders confident in the direction (long or short) of their positions.

-

For those seeking high leverage without the risk of liquidation before settlement.

How does Smart Leverage work?

Smart Leverage shields leveraged positions from liquidation by allowing you to enter high-leverage trades without the risk of liquidation before settlement.

Traditional Derivatives Trading

In traditional Derivatives trading, a trader entering a long position with 100x leverage risks liquidation with just a 1% price change.

Smart Leverage

With Smart Leverage, you can select leverage products based on your risk preferences. Price fluctuations before settlement time do not impact your invested amount, even if it falls below the breakeven price.

Trading Performance

-

The outcome is determined only at settlement time.

-

If the settlement price is greater than or equal to (for long positions), or less than or equal to the breakeven price, it's considered a win.

-

Conversely, if the settlement price is lower (for long positions) or higher (for short positions) than the breakeven price, the entire invested amount is lost.

Read More

Introduction to Smart Leverage

Is Identity Verification required for Smart Leverage?

Yes, individual users are required to complete Identity Verification Lv.1 to purchase Smart Leverage plans. To initiate your Identity Verification, please click here.

Do note that Business Identity Verification users are also supported to purchase this product.

Are there any fees associated with Smart Leverage?

No, there are no fees associated with Smart Leverage.

What are the risks of Smart Leverage?

You may risk losing your investment if the settlement price falls below (for long positions) or above (for short positions) a certain point at settlement time or redemption time. It's advisable to simulate expected results before subscribing to understand the associated risks.

How can I calculate my PnL with Smart Leverage?

To calculate your Profit and Loss (PnL) with Smart Leverage, use the following formula based on the settlement price compared to the breakeven price.

|

Direction |

Scenarios |

Calculations |

Outcomes |

|

Long |

Settlement Price ≥ Breakeven Price |

Payoff = Investment Amount + [Investment Amount × Leverage × (Settlement Price - Breakeven Price ) / Breakeven Price] |

You will receive your investment amount and the leveraged return. |

|

Settlement Price < Breakeven Price |

Payoff = max (Investment Amount + [Investment Amount × Leverage × (Settlement Price - Breakeven Price) / Breakeven Price], 0) The minimum payoff is 0. |

You may sustain some losses. In the worst-case scenario, you will lose your entire investment amount. | |

|

Short |

Settlement Price ≤ Breakeven Price |

Payoff = Investment Amount + [Investment Amount × Leverage × (Breakeven Price - Settlement Price ) / Breakeven Price] |

You will receive your investment amount and the leveraged return. |

|

Settlement Price > Breakeven Price |

Payoff = max (Investment Amount + [Investment Amount × Leverage × (Breakeven Price - Settlement Price) / Breakeven Price], 0) The minimum payoff is 0. |

You may sustain some losses. In the worst-case scenario, you will lose your entire investment amount. |

What is the breakeven price determined?

The breakeven price is determined based on factors such as volatility and time remaining until expiration. You can close orders at any time before settlement.

How is the Settlement Price determined?

The Settlement Price is determined by calculating the average price of the Derivatives Index Price every second during the 30 minutes leading up to expiration. Please note that in case of early redemption, the settlement price will be the index price upon redemption.

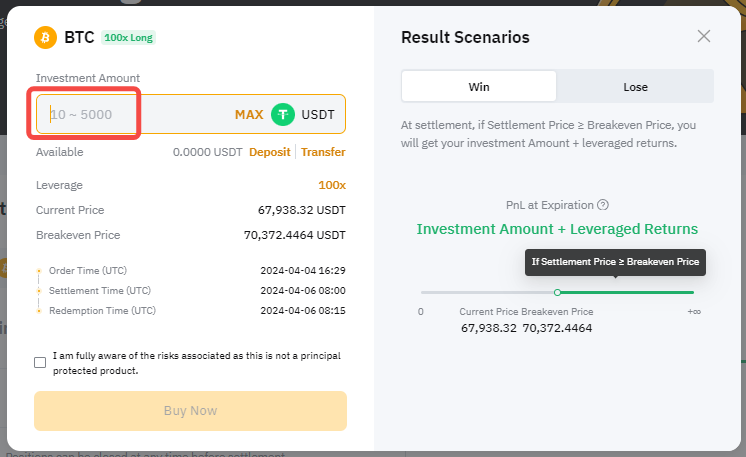

Are there any investment amount limits?

Yes, there are investment amount limits that can be found in the order zone. However, there is no maximum limit for the total investment amount per user.

When will my Smart Leverage plan take effect?

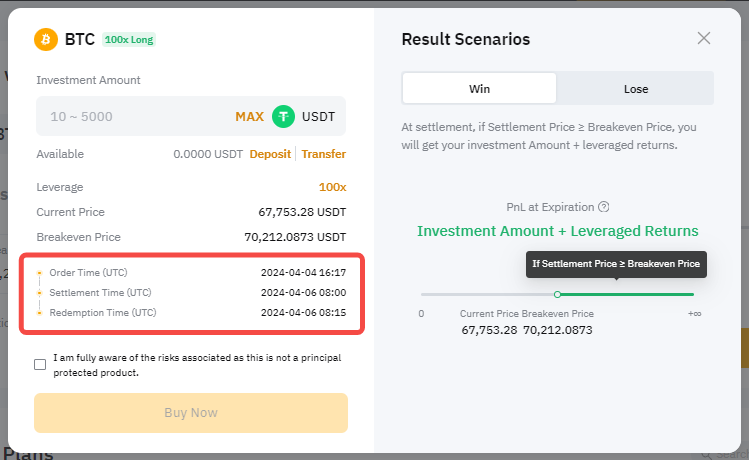

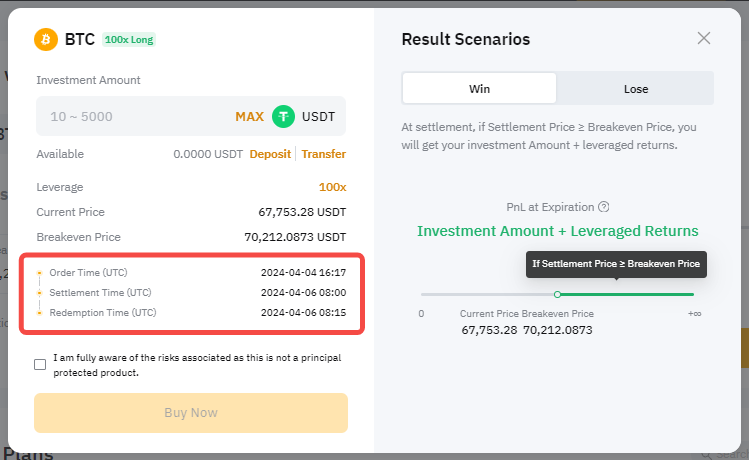

Your plan will be immediately created once you submit your order. Please refer to the order time (UTC) on the order page for the exact timing of its activation.

If I make a profit, when will I receive my payoff?

Profits will be credited to your Funding Account 15 minutes after your Smart Leverage plan is settled. For example, if the settlement time is T+1 at 8AM UTC, you will receive the payoff plus the initial investment amount on T+1 at 8:15AM UTC. For more details, please refer to the information available on the order page.

What is the source of profit from Bybit Smart Leverage?

Profits from Smart Leverage are generated through the active management of invested funds by professional third-party institutions, engaging in strategic trading within the Bybit platform.

Can I redeem my order before settlement?

Yes, orders can be redeemed at any time before settlement. The proceeds from redemption will adhere to the payoff formula at settlement, with the settlement price based on the index price upon redemption.

Notes:

— There may be a slight discrepancy in the actual proceeds, capped at 0.5% due to market movement.

— Early redemption is not possible if the calculated payoff is negative or equal to 0. Additionally, it will no longer be available starting from one hour before settlement.

Can I purchase Smart Leverage products using Subaccounts?

Yes, Subaccounts can be used to purchase Smart Leverage products.