What is the Bybit Card?

Bybit Card is a Mastercard prepaid card that allows easy and secure access to your funds wherever and whenever making it the ultimate companion on your crypto journey.

With a reliable and convenient way to off-ramp your crypto and spend on the go, Bybit Card helps you to maximize and fully integrate crypto into your daily life. You can use your earnings from Bybit's full suite of trading products and pay for your purchases instantly.

You can also unlock a world of exclusive benefits with the Bybit Card Loyalty Rewards Program—including rewards from partners, such as unique offers and special experiences. For more information, please visit this page.

Who can apply for the Bybit Australia Card?

You will need to be able to provide the following documents during Bybit Australia Card application:

- Identity Verification: Proof of Identity such as National ID, Passport, or AU Driving License.

- Residential Address and/or Address Verification: Valid Australian residential address and/or Proof of Residence in Australia

Bybit reserves the final decision to decline any applications upon internal evaluation of risk at Bybit’s discretion. For more information on Bybit Card application guide, please refer to this page.

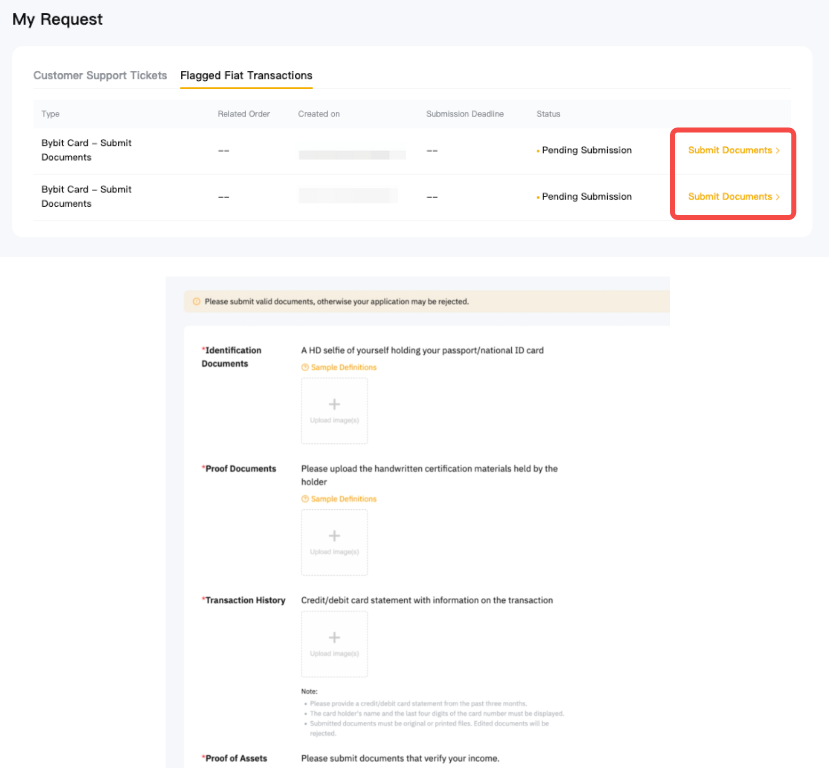

What should I do if I receive an email requesting document submission?

If you receive an email asking for more information, please click on Submit. You will be redirected to a page where you can submit the requested documents.

Notes:

- The list of requested documents may vary between individuals. You may click on Sample Definitions under the document description to find out more about the requirements.

- We only support PNG, PDF, JPG, and JPEG files that are not more than 10 MB.

- We can only accept a maximum of 5 documents per request.

After you have submitted the requested documents, the relevant team will review your case within 7 business days. You will receive the outcome through your registered email.

How can I cancel my Bybit Card Application?

Please refer to the following instructions based on the status of your Application:

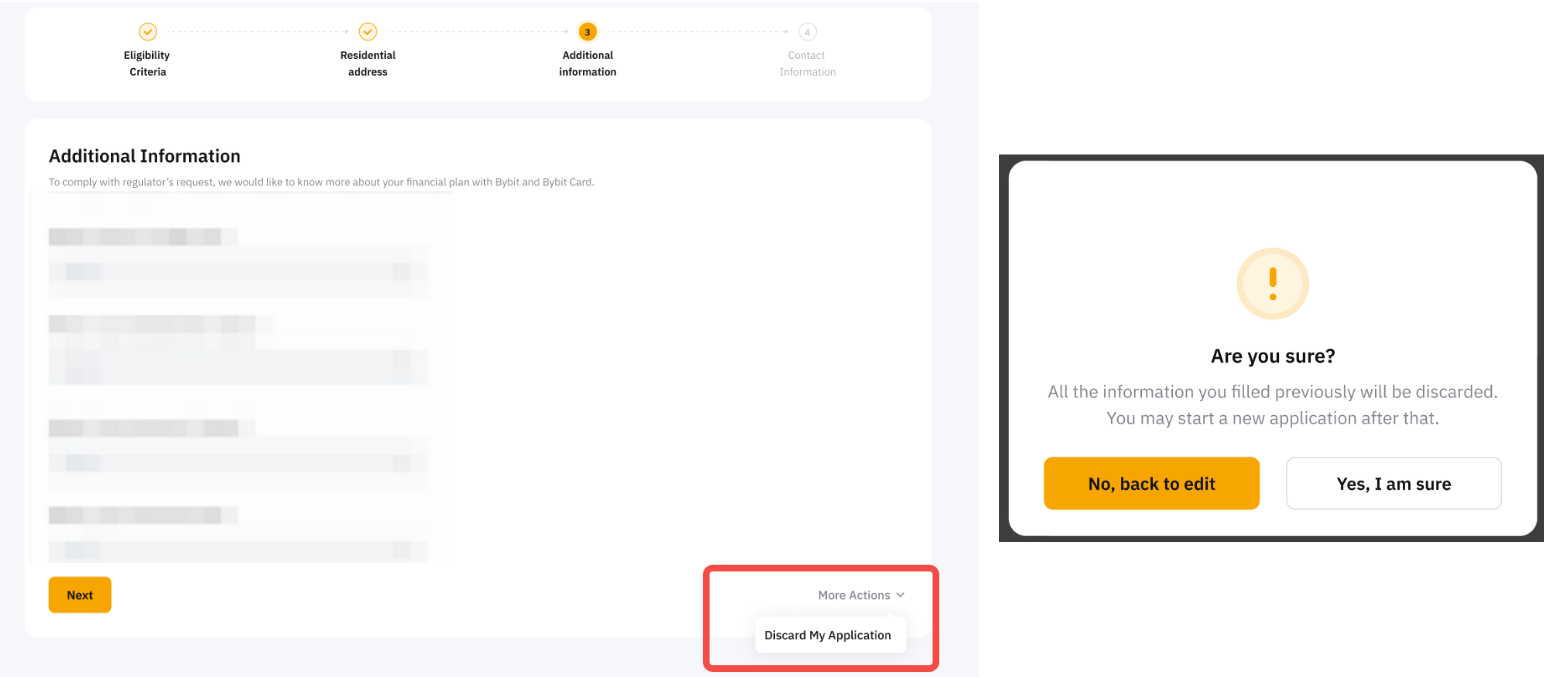

a) If you haven’t submitted your application:

If you are still in the process of applying for the card and haven't submitted it yet, you can click on More Actions and select Discard My Application to cancel it.

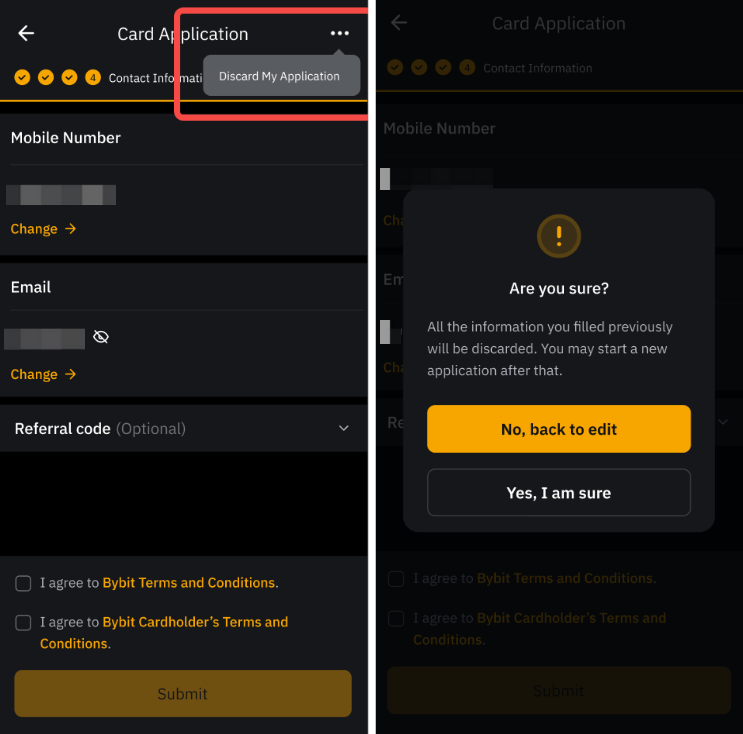

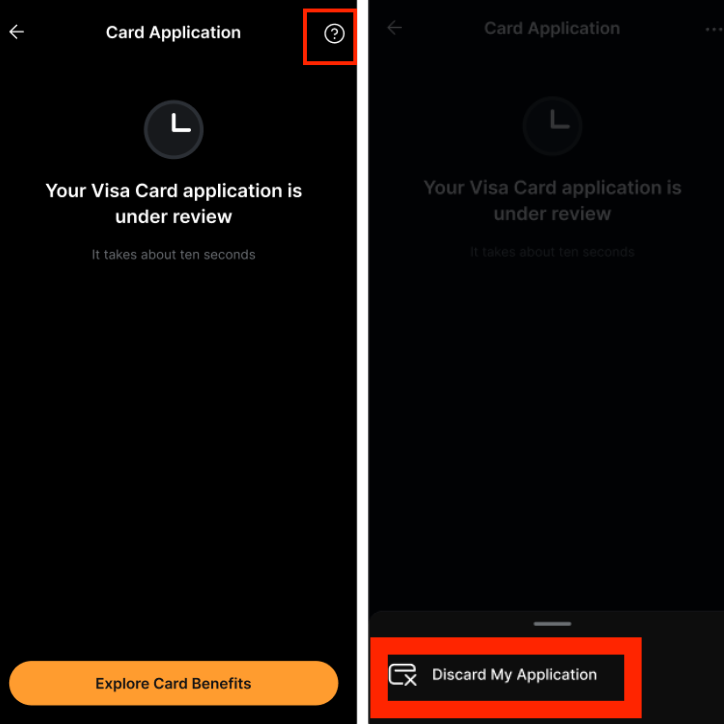

On the app, tap on the three dots icon and select Discard My Application.

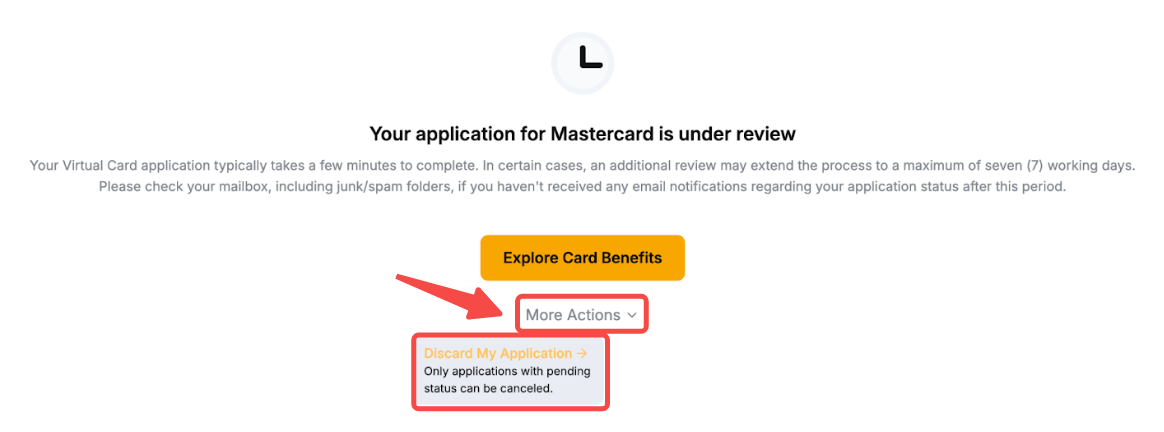

b) If your application is pending for review:

You can cancel your Bybit Card application by clicking on View my application → More Actions and selecting Discard My Card Application

On the app, you can click on View my application and then on the '?' button. Then, choose Discard My Card Application.

Notes:

- Only Bybit card applications with a Pending status can be cancelled.

- If your card application got rejected after submission, you can always Start Over with a new application.

c) If your application is approved:

To cancel your application after submission, please go to the Card Management page to terminate it. For guidance, you may refer to this article.

What is the maximum number of active Bybit Cards that I can apply for?

You can only have one standard virtual card, and one physical card at any one time.

Is there a limit on how many times I can reapply for virtual card approval?

You can maximum reapply a virtual card up to 3 times a day or 16 times in a month.

Can Bybit Card be added to digital wallets like Apple Pay, Google Pay or Samsung Pay?

Adding your Bybit Card to digital wallets like Apple Pay, Google Pay and Samsung Pay is supported for Bybit Card. However, please note that adding your card to Samsung Pay is only supported via Samsung Pay. For a guide on how to bind your Bybit Card to Apple Pay and Google Pay via the Bybit App, please consult this article.

Which currencies does Bybit Australia Card support?

The currencies for Bybit Card are composed of one fiat currency and multiple crypto assets.

- Supported fiat currencies: USD

- Supported crypto: BTC, ETH, XRP, USDT, USDC & TON

I have multiple supported cryptocurrencies in my Funding Account, which crypto will be utilized for my Bybit Card transactions, and in what sequence?

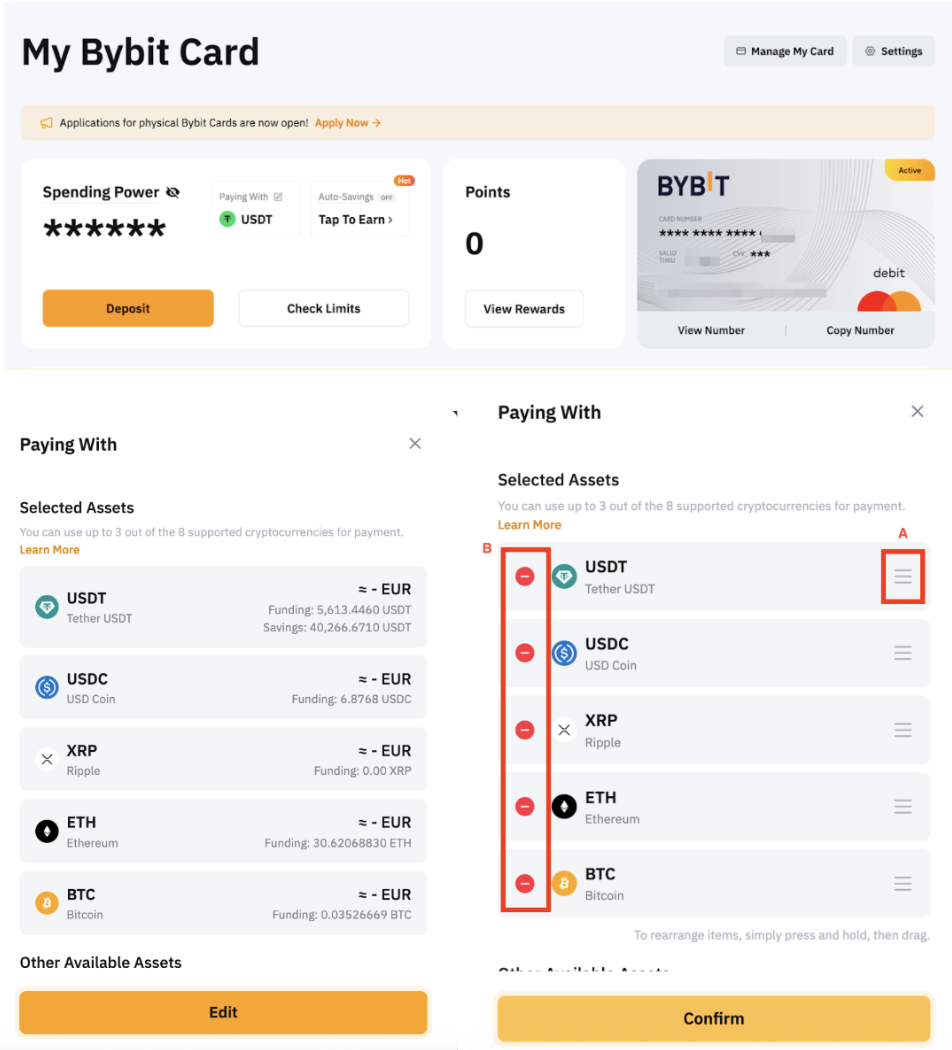

You can select up to 3 types of payment crypto for your Bybit Card transactions and the default payment priority is USDT > USDC > BTC. However, you can manage your spending currencies, including adding, removing, or changing the order on the Card Dashboard page.

Note that existing users (before 13/05/2025) can keep up to 6 currencies unless they edit settings, then a 3-currency limit applies; while new users (after 13/05/2025) are limited to 3 currencies by default.

Click on the Paying With and you will be prompted to a manage window. Then, you can either (a) manage the order by dragging it up and down or (b) add and remove the coins from the list. Once complete, you can make a purchase using your Bybit Card, the system will follow the payment priority you've set.

I have completed my Identity Verification, why am I required to verify again during the Bybit Card application?

Bybit Card has more stringent requirements for Identity Verification. Hence, you may be required to update your Identity Verification even though you have already completed your Bybit account’s Identity Verification previously.

For more information on the Bybit Australia Card application guide, please refer to this page.

What are the fees associated with Bybit Card?

Please refer to Fees and Limits.

How to activate your Bybit Card?

Please go to your Settings page and complete your personal information which includes your Billing Address and Mobile Number before you can unlock the access to online and overseas transactions. To learn more about how to activate your card, please consult this guide.

Can I change my phone number in the Bybit Card settings?

Yes, the number added in the Bybit Card can be changed and will be utilized for Bybit Card transactions. Please note that it operates independently from your Bybit account.

If you would like to change the mobile number associated with your Bybit account, please refer to this guide.

How to activate my Bybit Card for overseas transactions?

There is no need to activate your Bybit Card for overseas transactions separately.

Can I apply for a physical Bybit Australia card?

Yes, once your address has been verified, you can apply for a physical Bybit Card.

How can I track my physical card delivery?

Currently, only the VIP users enjoy the DHL delivery tracking services. Find more information here on how to apply for a VIP. For application procedure, please refer to this guide.

Can I appeal if my Bybit Card application is rejected?

Yes. Please submit your application appeal request here. However, Bybit reserves the final decision to decline any applications upon internal evaluation of risk at Bybit’s discretion.

How to deposit funds to my Bybit card?

Bybit Card does not have its own wallet balance. Instead, it derives funds from your Funding account. As such, you will need to make sure your Funding account has sufficient funds to use your Bybit Card.

You can deposit funds to your Funding Account by purchasing fiat or crypto using our Buy Crypto function. You can also deposit crypto from other platforms/wallets.

A guide on how to buy crypto can be found here.

How to use my Bybit Card?

You can use your Bybit Card at any merchant that accepts Mastercard. Please note that the Bybit Card is a debit card. Therefore, you will not be able to use it for credit card transactions. Illegal use in connection with your Bybit Card is prohibited and may result in termination.

To learn more about how to make payments with your Bybit Card, please click here.

How many Bybit Cards can I hold at one time?

You can only hold one active virtual Bybit Card at a time. You may apply again after you terminate the card.

How long is the Bybit card valid for?

Bybit Card is valid for 3 years. The virtual Bybit Card will be automatically renewed after expiration.

How to upgrade my Bybit Card tier?

Bybit Card tier follows your Bybit account's VIP level. For more information on the Bybit Card benefits of different VIP levels, please refer here.

Can I adjust my Bybit Card spending limits?

No. For more information, please refer to Fees and Limits.

Will there be a monthly Bybit Card statement?

No, there will not be any Bybit Card monthly statements provided.

Will my Bybit Card be temporarily suspended if my Bybit account is suspended?

Your Bybit card will not be suspended. However, your Bybit card transactions will fail if your Bybit account is suspended.

What should I do if my Bybit Card is lost or stolen?

Please report your Bybit Card as Lost/Stolen immediately. To learn more about how to process, please refer to Security and Verification.

Can I change the shipping address for my physical Bybit Card after my application has been approved and the payment was made?

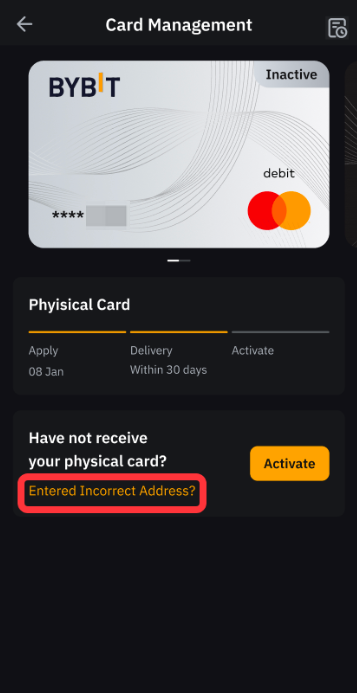

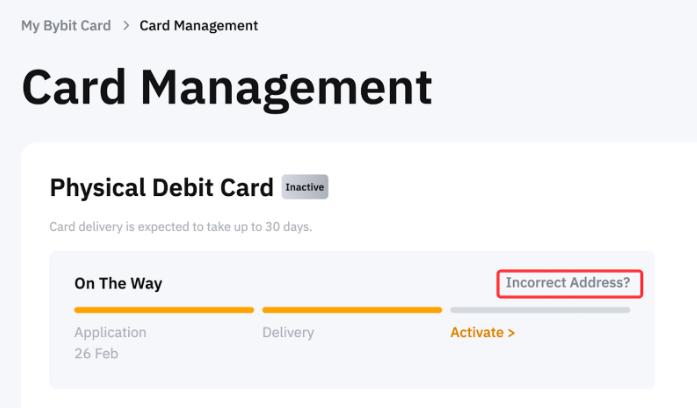

Yes, you can change your shipping address once within 30 days upon application. You may click on Incorrect Address? on the Card Management page to request the termination of your current order, edit your shipping address and submit a new physical application.

On the App

| On the Website

|

How long does it take to get my physical Bybit Card?

The Bybit Card team will arrange to deliver your physical Bybit Card to your address as soon as possible. Please wait patiently for it to be delivered as there might be a delay due to high demand. Depending on your country of residence, it typically takes up to 30 days for the card to be delivered.

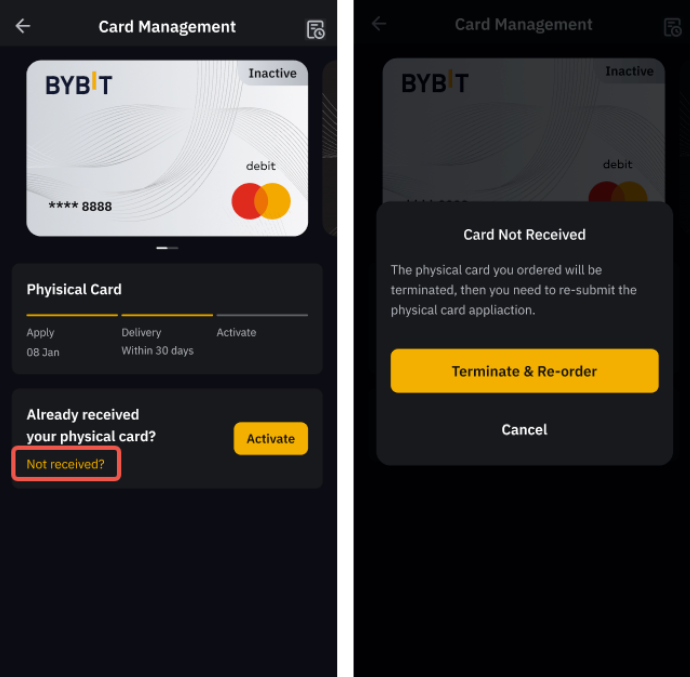

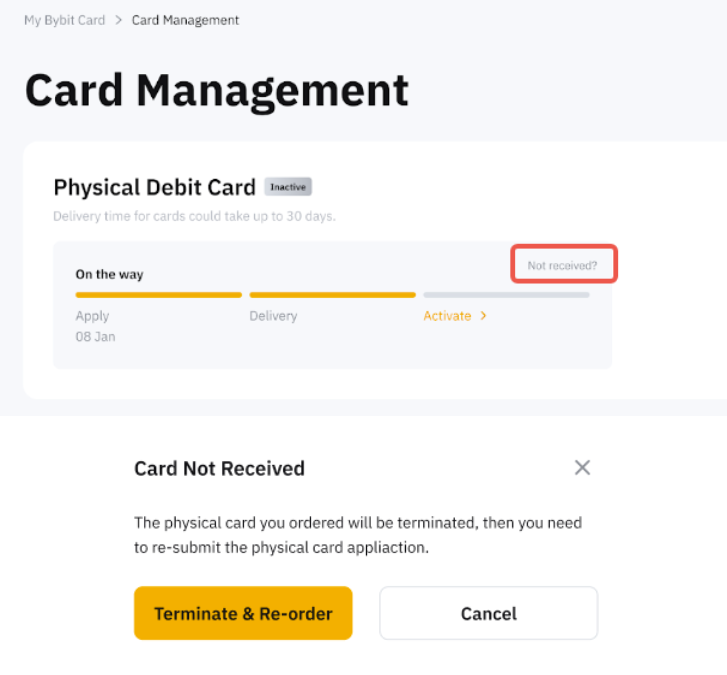

What should I do if my card does not arrive after 30 days?

You may click on Not Received? on the Card Management page to request the termination of your current order and submit a new physical application.

On the App

| On the Website

|

When should I activate my physical Bybit Card?

You can activate your physical Bybit Card upon receiving it. To learn more about how to activate your physical card, please refer to this page.

Is there a deadline to activate my physical Bybit Card?

There is no deadline for activating your physical Bybit Card.

I have previously terminated my physical Bybit Card. Can I re-order it?

You can re-order a new physical Bybit Card if you have previously terminated it. You may refer to the steps here.

Can I make contactless payments with my physical Bybit Card?

You can make contactless payments with your physical Bybit Card at retail merchants with contactless-enabled point-of-sales (POS) terminals. Please note that in order to initiate a contactless payment, you need to first complete a Chip and PIN transaction (that is, insert the card into a POS terminal and authorize it with your PIN) with your physical Bybit Card.

In Europe, the contactless limits under the PSD2 regulation also apply to Bybit Card. Currently, the maximum amount of a single contactless payment is 50 EUR, and the cumulative amount of contactless payments is 150 EUR. Additionally, the maximum number of consecutive contactless payments is 5 times. If you're making a contactless payment that exceeded these limits, your transaction will be declined. You may reset the limit by performing a Chip and PIN transaction on your next payment, after which, you will be able to make contactless payments again.

How can I withdraw cash from an ATM with my Bybit Card?

You can withdraw cash with your physical Bybit Card from any ATM worldwide that supports Mastercard (look out for the Mastercard logo!).

Are there any ATM fees and limits for my Bybit Card?

Yes, there is a 2% Bybit Card ATM withdrawal fee for the amount that exceeds 100 USD each month. Bybit Card foreign exchange and/or crypto conversion may also apply (if any). Please refer to Fees and Limits (Bybit Card) article for a more detailed explanation.

In addition, some ATM merchants may charge an ATM Access Fee and/or may prompt currency conversion to your card currency. Do take note of this and read the instructions on the ATM screen carefully. These are fees and services provided by the ATM service provider.

Are there separate spending limits for my physical and virtual Bybit Card?

No. Both physical and virtual Bybit Cards share one limit. For more information, please refer to the Fees and Limits (Bybit Card).

How do I order a replacement for my physical Bybit Card?

If your physical Bybit Card is damaged/not working, or you have reported the loss of your physical Bybit Card, you can order a replacement for your Bybit Card by following the steps here.

Why are there only 4-digit PIN code options available when I attempt to withdraw money from any ATM using my Bybit Card?

This issue is caused by the settings of the ATM machine in use which will display a 4-digit pin by default. However, you must continue entering the authorized 6-digit PIN code even though the ATM system only has a 4-digit PIN option to carry out the withdrawal process using Bybit Card.

What is the Bybit Multiple Card Program?

The Multi-Card Access feature on the Bybit Card dashboard allows eligible users, based on KYC requirements and their country of residence, to apply for and hold both Visa and Mastercard Bybit Cards at the same time.

Why don’t I see the option to apply for a second card?

If you don’t see the option, it means you are not currently eligible. This could be due to your VIP status, KYC level, or country restrictions.

Who can apply for the Multiple Card Program?

Only VIP users who meet the KYC eligibility requirements for the Bybit Card program can apply.

If I upgrade to VIP status, will I instantly gain access to the Multiple Card Program?

Yes. Once your VIP status is active and you meet the KYC requirements, the option to apply for a second card will appear on your Bybit Card dashboard.

If I apply for a second card, will it have a separate spending limit?

Yes. Each card comes with its own spending limit, giving you a higher total available spending capacity.

Will my cashback or rewards be split between both cards or combined?

They are combined. Cashback and rewards earned from both cards will be credited to the same account.

If I already have two cards, but lose my VIP status, will it affect my cards?

No. You will not lose access to your existing cards. Both cards will remain active, and once issued, they will not be deleted.

Can I choose different currencies for each card?

No. The card is issued in a default currency based on your region. You cannot change or select another currency.

Any feedback about Bybit Card, let our product team know here!